Strong Q2 Housing Pipeline not yet Reflected in New Building Activity

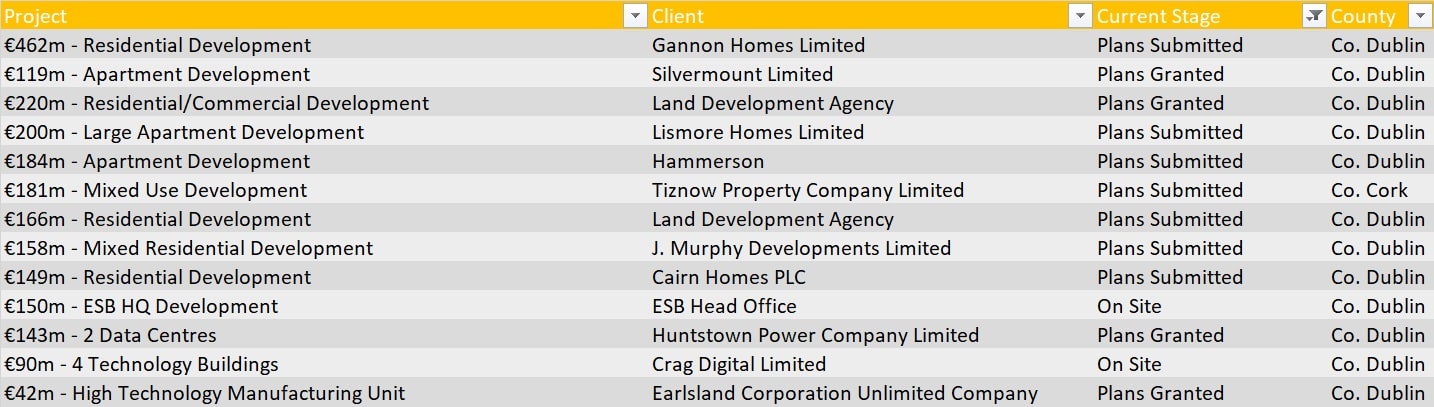

Pipeline investment in residential development in Ireland, reflected in new planning applications, rose to €6.6bn in Q2 2022 – the highest level ever recorded for any quarter. Four hundred and seventy-one applications were lodged equating to over 32,000 units – 22,000 of which are apartment units. Almost a quarter of these units can be attributed to Strategic Housing Development (SHD) applications, which were set to be phased out between December 2021 and April 2022. On the ground activity remains steady however with just under 7,500 units commenced in the quarter. As expected, the rise is greatest in and around Dublin where applications for apartment units equated to over 18,000 new units. All regions in Ireland however did show increased investment in housing with Southern region planned investment rising by 54% from the same period last year and Northern and Western region investment rising by 141%. New planning applications in the non-residential sectors fell in value by nearly 20% compared with last year.

Planning grants across all sectors remained steady falling by 3% from Q2 2021 but recovering from falling levels of investment in the previous three quarters. Plans granted for data centres, warehousing, storage and distribution continue to grow at a steady pace. Although project starts for the quarter were down over 50% on Q2 2021 this can be explained in large part by the restart of ‘on the ground’ activity in this quarter after the virtual shutdown in Q1 2021. Only the Education sector bucked this trend with some large projects going on site.

Top ROI projects on CIS in Q2

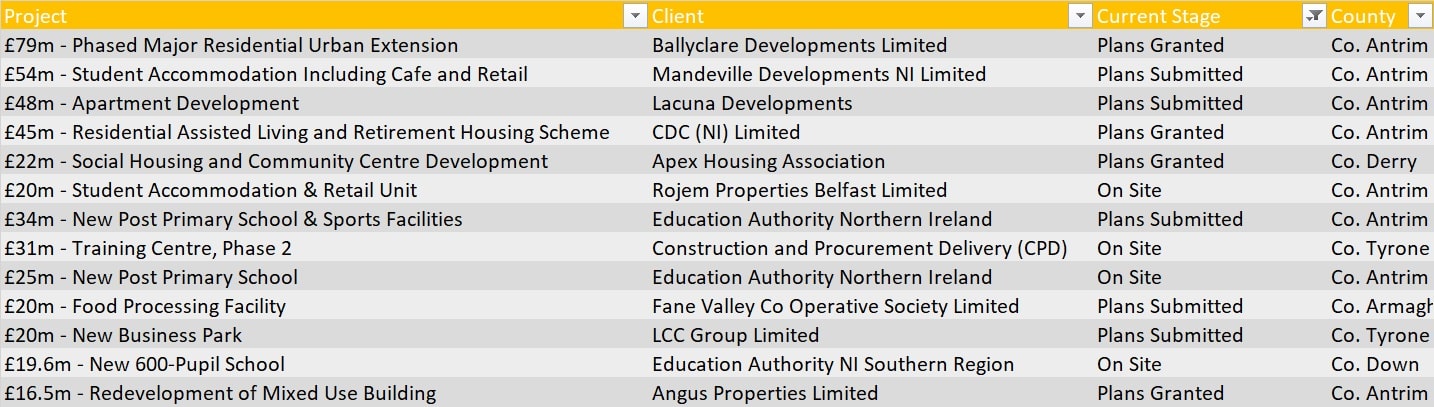

In Northern Ireland the value of plans submitted fell by 9.7% from Q2 2021 – the third consecutive quarter to fall below the previous 5 year average. Planning grants however rose significantly to £648m, a 24% increase from the same period last year- the highest level of pipeline investment since Q2 2019. Project starts were down 28% from Q2 2021 but again must be viewed in the context of the restart of works after pandemic shutdowns in Q1 2021.

Top NI projects on CIS in Q2

This article merely scratches the surface of what CIS has observed throughout Q2 2022. In our new complete CIS Insights package, we now give fully verified, real-time construction analysis within a fully interactive tool which can be customised to the parameters that most influence your company decisions and goals. There is no need to wait for quarterly reports with CIS insights because it allows you to conduct industry analysis on a monthly, weekly, and even daily basis!

Quarterly Reports / CIS Insights

"*" indicates required fields

Download CIS reports by clicking the button below.

Download CIS reports by clicking the button below.