Construction Projects at On-Site Stage in the Republic Of Ireland

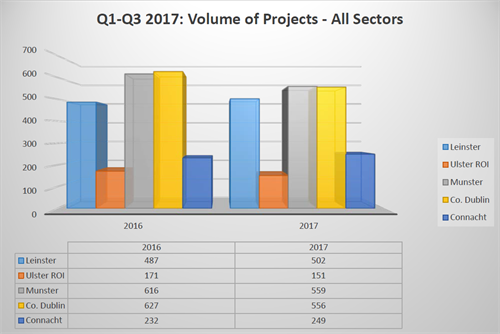

In the Republic of Ireland, the volume of projects On-Site in the first 9 months of 2017 has fallen by 5% when compared to the same period in 2016. All regions, with the exception of Leinster and Connacht have fallen in volume terms as per Fig. 1

The value of projects On-Site is down 20% to €4.7 billion with all regions experiencing sharp decreases in activity apart from Connacht and Munster. On a sectoral basis by value, only Residential, Community & Sport, Agriculture and Medical & Care Residential have grown in the 9 months of this year. The Residential sector now represents over 30% of the value of projects On-Site, up from 21% in the previous year.

Construction Projects at Plans Granted Stage in Republic Of Ireland

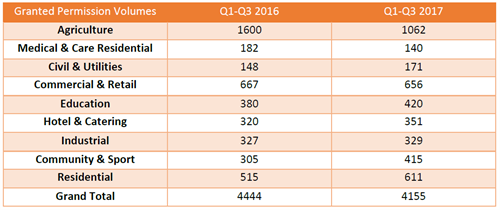

The volume of projects granted planning is also down by 7% on the same period last year with 4,155 major projects granted planning in the period under review. However, as can be seen by the table below, Agricultural projects make up all of this drop and they have seen the largest decrease in volume of projects with only 1062 projects granted planning (Fig 2).

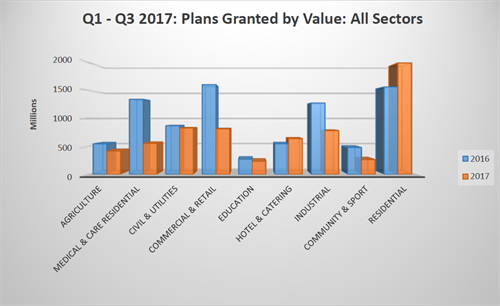

In continuing trends from H1 2017, the value of plans granted (Fig 3) has fallen by 23%. All sectors have experienced a decrease in the value of projects granted planning with the exception of Hotel & Catering which is up 17% and Residential which is up 27%. The greatest drops have been seen in the Medical, Commercial and Community & Sport sectors.

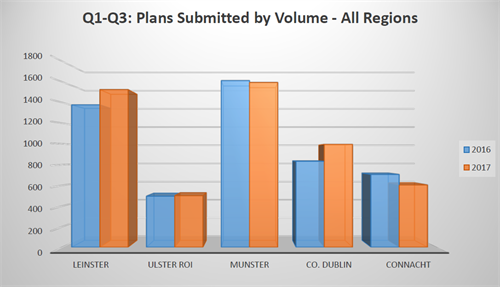

Construction Projects at Plans Submitted Stage in Republic Of Ireland

The volume of projects submitted for planning increased slightly by 4% to over (Fig 4) 5,220. All of this drop of 200 can be explained in the Agriculture Sector where volumes have fallen by 27%. All other sectors have displayed growth in the period. The volume of projects has fallen in the Connacht and Munster regions while all other regions have shown an increase from the same period in 2016. Over 970 projects have been submitted for planning in the Residential sector in the first 9 months of 2017, a 25% increase on 2016 levels.

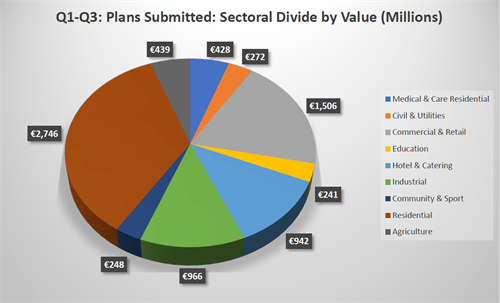

The value of projects submitted for planning in the first 9 months of 2017 is down slightly (Fig 5) in comparison with the same period last year. Residential is worth almost €2.75 billion in projects submitted for planning, an increase of 27% on the same period last year. The growth of the Residential sector masks the decrease in value of projects in the Agriculture, Civil, Commercial, Education and Industrial sectors.

For a free pdf report of our Q3 Construction Market Review, click here

For more information on our statistics ot construction leads intelligence service call us on 01 2999 200 or email [email protected]

Download CIS reports by clicking the button below.

Download CIS reports by clicking the button below.