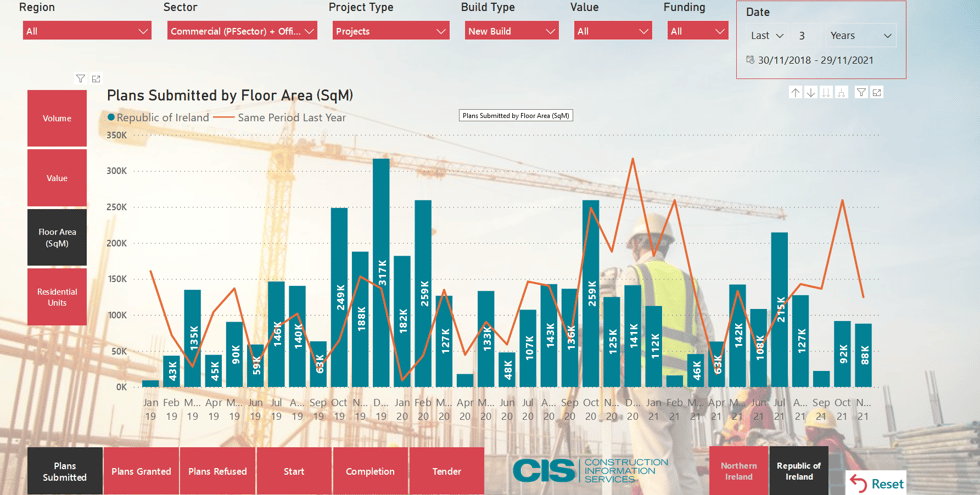

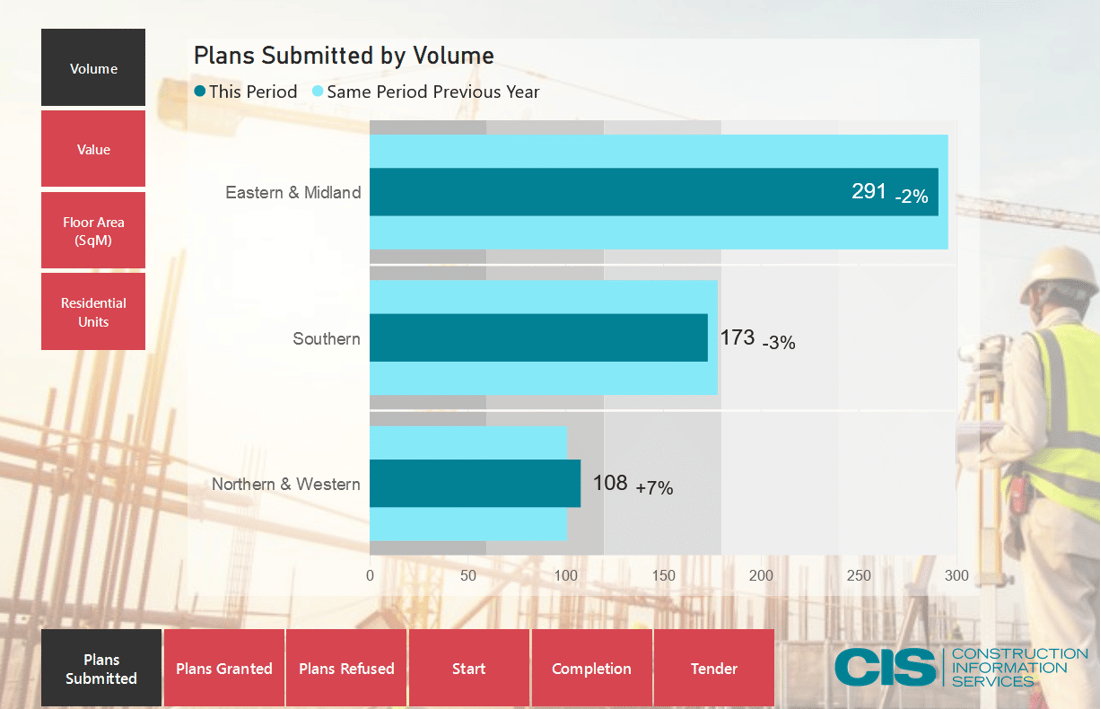

Using our system’s data analysis and trends observed in news channels, it is evident that new construction office space has decreased dramatically over the last two years. There are numerous possibilities for the cause of this decrease. Covid-19 has halted building across the board, but it isn’t the whole picture. With tax legislation coming into effect in Ireland, multinational corporations will have less of an incentive to remain primarily located in Ireland, therefore existing space will suffice. This is evidenced by the fact that, while GDP increased from 2020 to 2021, GNP did not increase in the same way, implying that multinational corporations have a lesser impact on the economy. Planning permissions submitted for these projects reduced from 214 in 2019 to 132 in 2021, a 38% decrease and the planning permissions granted reduced 147 in 2019 to 111 in 2021, a 24% decrease.

As of May 18th According to a new survey, more than 95% of working individuals in Ireland want to continue working remotely once the pandemic is over. Employees favor remote working more than managers and team leaders, according to the survey. According to the NUI Galway study, 95% of respondents who could work remotely were in favor of working from home on a regular basis. This is the second such study of its sort, and the proportion of persons who stated they would prefer to work entirely remotely has climbed significantly since the first nationwide survey in April 2020, jumping from 12% to 32%. The percentage of people who want to do some type of remote work has also climbed since last year’s study, rising from 83% to 95%.

By the beginning of October, demand for office space in Dublin had risen sharply in the third quarter of the year, as the Covid-19 restrictions were eased, focusing attention on the post-pandemic work environment. According to JLL research, which analyzes Dublin office market deals, take-up of space in the three months to the end of September was about 428,000 sq ft, a huge increase from 45,000 sq ft in the first quarter and 216,000 sq ft in the second. A total of 43 transactions were reported in the most recent quarter, despite the fact that the three-month period was still lower than prior average quarterly volumes. The suburban market saw strong take-up, with 58% of office space being taken outside of the city centre. According to JLL’s research, the highest transaction of the quarter was a 44,000 sq ft lease to BNP Paribas Bank at the Termini in Sandyford, with the second largest at Cherrywood being an almost 37,000 sq ft letting to Accenture. Contrary to what was previously stated, our research shows that there is a market for commercial office space and that occupiers are filling up quickly. However, this just demonstrates that companies want to maintain the current equilibrium by not expanding, implying that the existing or ready-for-renovation office space is sufficient in the long run.

What does this mean for the future of building new commercial units targeted for office space? Due to the general shift in the nature of how society functions with the onset of the remote working environment, the demand for office space has been reduced to varying degrees. The decrease in demand, as well as all of the previously mentioned concerns relating to material and labor constraints, will slow the pace of this sort of development at least until late 2022. Any rise we see once the market settles will most likely be less than the 2019 global production high.

Warehouses

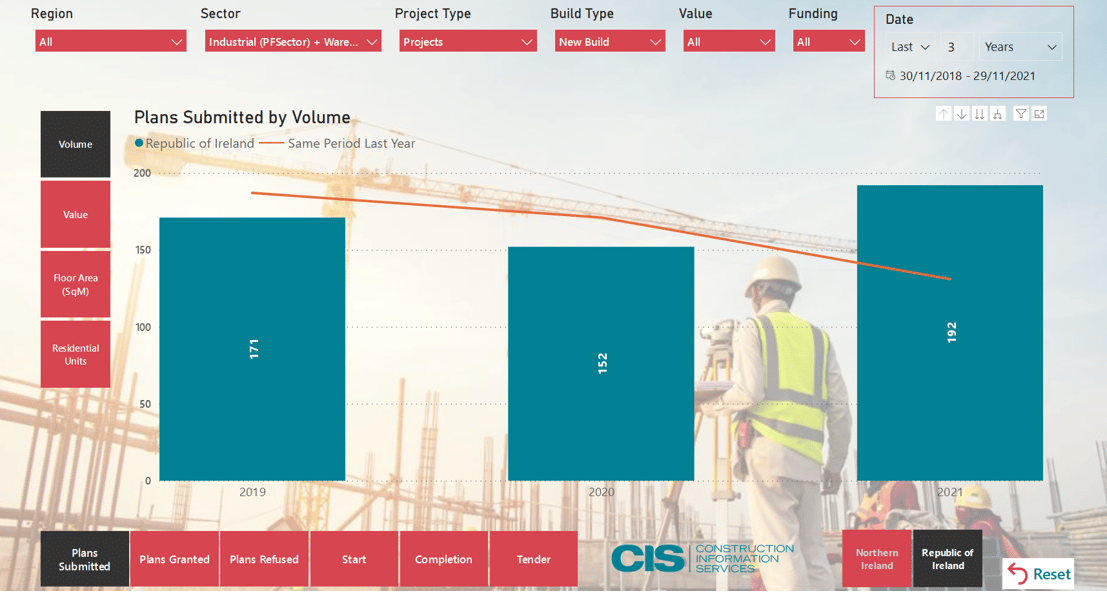

Contrary to the previous sectors mentioned there seems to be an increasing demand in warehouse space in the Irish market. From our own data there is a clear increase in the aggregate square footage of warehouse space as compared to 2019 or 2020, with Q2 2021 being 179k sq. ft, Q3 being 245k sq. ft and Q4 thus far reaching 64k sq. ft. When comparing to the average quarter of 2019 (40k sq. ft) and 2020 (72.5k sq. ft) there is a significant increase with 2021’s average 122.5k sq. ft triple 2019 and more than the combined previous two years.

The industry had experienced strong growth for most of the period as of June 14th, 2021. This has been fueled in large part by increased online sales, which have fueled industry demand as products have been kept in storage for extended periods of time rather than being delivered to brick-and-mortar retail shops. The sector was also aided by an increase in the number of online-only stores operating in Ireland. Furthermore, as the economy improved, consumers’ purse strings loosened, allowing overall retail sales to rise, albeit at a much slower rate than online sales, supporting demand for industry services by increasing stock flows through warehouses and distribution centers for the majority of the period.

According to Savills study, Prologis predicts that an additional 770,000 sq. ft. of warehouse space is required in the UK for every additional one million spent online. Prior to Brexit, much of this increase would have been lost to the United Kingdom, as it accounted for a substantial portion of internet delivery. However, Brexit-related disruption is changing this model, as indicated by Amazon and 3PLs planning to establish additional operations in Ireland, implying that gains in online sales will translate more closely into greater warehouse demand in the future. The early signs of strength from Irish exports in the face of Brexit are promising while imports from the EU should be able to fill gaps created by Brexit. The agricultural sector is perhaps the most exposed sector but will have little impact on the industrial and logistics market. Ireland’s EU membership, which provides access to the common market, should create numerous opportunities, and give firms greater flexibility as supply chains come to terms with the fallout from the Brexit trade deal. In terms of e-commerce, Ireland is anticipated to experience a growing demand for warehousing and associated logistical infrastructure as commodities traditionally kept and supplied in the United Kingdom, be onshore in Ireland.

What does this mean for the future of warehouse construction in Ireland? External causes such as the pandemic, remote working, and the most significant impact (Brexit) have increased demand for our own warehouses more than ever before, and we can already see the trend. With this in mind, the years 2022-2024 will only go further if the same conditions persist between the UK and the EU, and they will create a new market for enterprises wishing to expand their construction services to the industrial sector.

From planning to completion, CIS monitors and tracks all construction activity in Ireland and Northern Ireland. Please do not hesitate to contact me at adargan@cisireland.com if you have any questions about this report. By clicking here or emailing sales@cisireland.com, you can also join up for a no-obligation free trial of CIS Online.

Download CIS reports by clicking the button below.

Download CIS reports by clicking the button below.