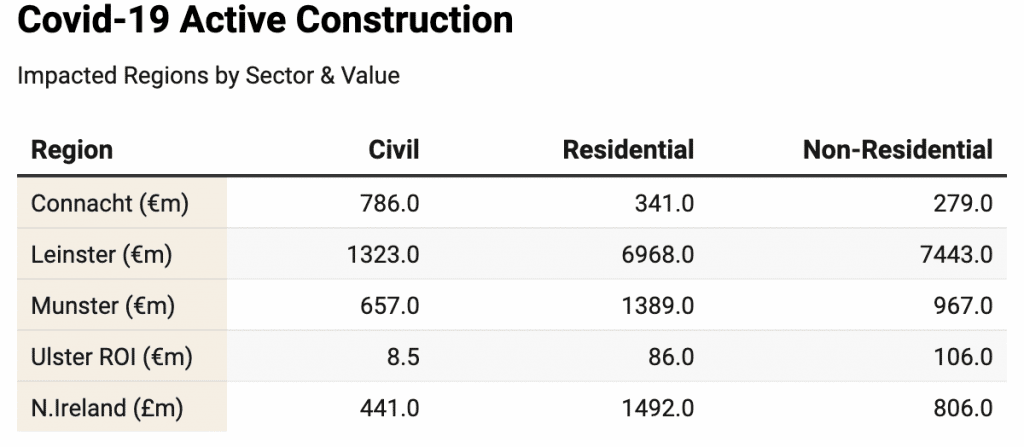

Coronavirus halts building of 60,000 homes in Ireland

Value of construction projects almost €10bn, including €925m in Northern Ireland

Covid-19 has halted the building of almost 60,000 new homes worth €10 billion across Ireland, figures published on Thursday show.

Construction ceased on all but essential projects last month to comply with restrictions aimed at stopping the spread of coronavirus, stalling projects worth an estimated €21 billion.

Developers were building almost 60,000 homes on 796 sites around the country when lockdowns began in March, according to Construction Information Services (CIS), which monitors the industry in Ireland.

The projects had a combined value of €9.55 billion, which included €925 million worth of work in Northern Ireland, says an update by CIS managing director Tom Moloney.

“Dublin alone had 185 active sites with a combined value of €4.3 billion,” Mr Moloney added. Work on about 23,000 homes was under way in Dublin.

CIS figures show that the restrictions stopped the construction of some 5,000 houses and 1,500 apartments in Northern Ireland, while they suspended work on 33,000 houses and 17,000 apartments in the Republic.

Listed house builders Cairn Homes and Glenveagh Properties confirmed that they would halt work after Taoiseach Leo Varadkar extended Covid-19 restrictions to construction last month. The two companies are working on more than 30 sites between them, many in or close to Dublin, the region hardest hit by the housing shortage.

Various bodies, including the Central Bank of Ireland, say the Republic needs about 30,000 new homes a year to meet demand but is falling short of this target, leaving the State with a housing crisis. Estimates of the number that would have been built in 2020 before the pandemic struck were about 22,000.

State projects

CIS has also identified 80 significant taxpayer-funded projects worth €3.21 billion that halted as authorities imposed restrictions, 56 in the Republic and 24 in the North.

In the Republic, contractor BAM Ireland stopped work on the national children’s hospital in Dublin, while road building and other “non-essential” State developments also stopped.

Minister for Finance Paschal Donohoe this week said the Government would pay builders working on State projects the cost of keeping sites closed during the lockdown.

Mr Moloney’s report states that CIS researchers identified 1,137 building sites in the Republic, with a combined value of €17.9 billion, where work has halted.

In Northern Ireland, it found 345 sites where building had ceased, estimating these to be worth more than £2.7 billion (€3 billion).

The restrictions have delayed the construction of 946 classrooms, work on hospital buildings that will hold 1,106 beds, nursing homes with 1,789 beds and 5,092 hotel bedrooms.

Planning applications “remain buoyant” in the Republic, but decisions have slowed recently, said the CIS. It was also noted that planning in Northern Ireland has declined markedly.

Mr Moloney warns that efforts to predict how construction will recover from the coronavirus crisis face too many unknowns.

CIS expects that work will restart first on sites where it was under way when restrictions came into force.

“The speed with which the industry can get back to the levels outlined here is dependent on many variables including financial capacity, materials and supplies, workforce availability, workplace conditions, legislative backlogs and government policy,” the report says.

Methodological Notes

CIS monitor construction activity in Ireland at project level. Our team of researchers track major projects from planning to completion and gather relevant data and metrics. The analysis in this report is based on projects over €500k/£500k and excludes self-build projects. Whilst we do track all projects, including residential self-builds and extensions, our analysis has shown that projects over €500k/£500k and residential developments of 10 units or more represent, on average, over 90% of total project value with their sectors. The figures on activity shown here represent gross figures for On-site activity. For expediency, we have not factored in the stage of developments or the degree to which they have been delivered. In particular we urge caution when looking at residential figures as many phases of these developments have already been delivered (with the exclusion of apartment developments).

Download CIS reports by clicking the button below.

Download CIS reports by clicking the button below.