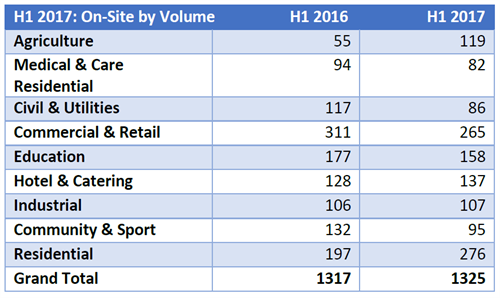

The overall volume of construction projects commencing On-Site in H1 2017 remains almost static at 1325 when compared to the same period in 2016 (1317) for the Republic of Ireland, which was in turn up 29% on 2015 levels. The table below provides an analysis by sector of the two periods under review. The 276 Residential projects below represent 7,596 units in multi-unit developments and equates to an average of 28 units per scheme.

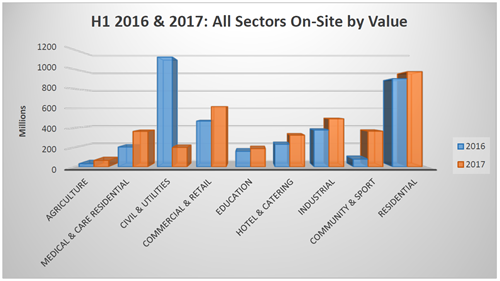

As per the graph below, the value of projects commencing On-Site is also static (H1 2017 – €3,597m versus H1 2016 – €3,583m), despite the fact that Civil & Utilities is down over 400% on H1 2016 levels due to the two major road schemes (totalling €675m) which started On-Site in Q1 2016. All other sectors are growing with the best performing sector in the analysis being Community & Sport which is up 79% on the same period last year (2017 – €445m versus 2016 – €78m). This increase is attributed to two major developments commencing construction – the Curragh Race Course redevelopment and the new Centre Parcs Holiday Village in Longford.

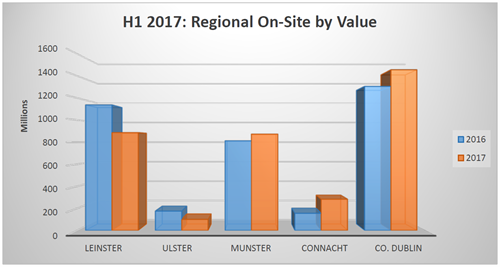

Looking at the regional analysis in project value terms for H1 2017 versus the same period in 2016, Leinster is down by €250m, however, the number of projects commencing On-site increased by 35. Ulster (ROI) is down both in value and volume – €75m and 4 projects respectively. In Munster, project values increased by €60m but the number of projects decreased by 16. Connaught showed positivity in both value and volume of projects for H1 – €150m and 32 projects respectively. Finally, Co. Dublin showed an increase in values of €151m but the volume of commencements decreased by 39.

The market share based on the volume of projects commencing construction is Munster 28%, Co. Dublin 27%, Leinster 24%, Connaught 13% and Ulster (ROI) 8%.

Plans Granted

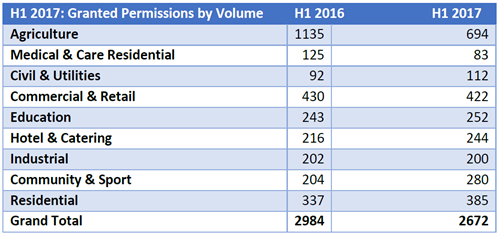

In a continuing trend from Q1 2017, the volume of Plans Granted continues to lag the corresponding period in 2016. The number of plans granted in H1 2017 is 2672, which is down 10.4% or 312 projects on H1 2016.

As can be seen in the table below, Agricultural projects have seen the largest decrease in volume with only 694 projects granted planning. Residential (excluding Self-build) recorded an increase in permissions by 48 projects over H1 2016, which amounts to 8,193 units.

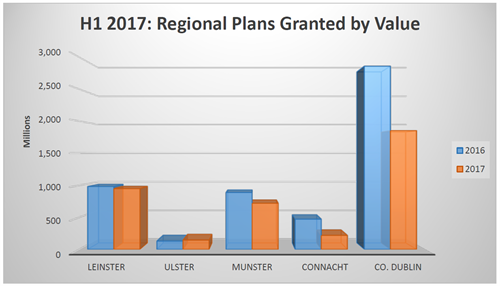

The value of projects granted permission in the period under review, reveals a dramatic drop on the corresponding period in 2016. There is a €1,447m decrease, the majority of which is attributed to two sectors – Medical & Care Residential and Commercial & Retail. On further analysis of these two sectors the €650m Children’s Hospital accounts for 90% of the decrease in values in the Medical & Care Residential, while in the Commercial & Retail sector the decrease is made up of a large number of projects in value ranges from €10m to €80m which were granted permission in H1 2016. It will not be surprising that the majority of these were in Dublin and mainly for offices, with the exception of three developments, two in Cork and one in Limerick.

Examining the projects granted in H1 2017 by Region, Munster shows the biggest decrease in volumes compared to 2016 at 208 projects, which represents €168m in value terms. Connaught had 67 less projects granted permission and these represented €253m in construction values. However, in Co. Dublin while the decrease was only 18 projects, the value was in excess of €1billion, which is mainly accounted for by the €650m National Children’s Hospital (currently at Contract Awarded), €300m expansion of the Water Treatment Plant in Ringsend (currently at Tender stage) and a €100m Office development at Hanover Quay (currently On-site).

Plans Submitted

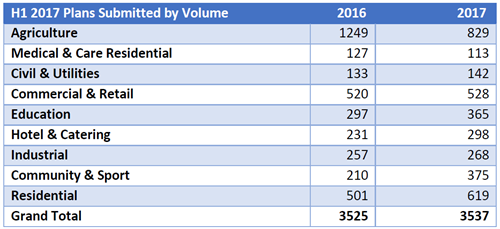

The volume of projects Submitted for Planning Permission increased slightly in H1 2017 to 3,537 over the comparable period in 2016. This is a positive reflection given we recorded a small decrease in Q1 2017 versus Q1 2016.

Growth in the Residential (24%), Community & Sport (79%), Hotel & Catering (29%) and Education (23%) offset the decreases in Agriculture (-34%) and Medical & Care Residential (-11%) as reflected in the table below.

In terms over construction values there was a €35m decrease in H1 2017 versus H1 in 2016. The Residential sector (excluding Self-build) represented the largest increase in both values and volume. The value of plans submitted amounted to €1.7 billion, which represents 13,199 units, which is an average of 21 units per development. The Hotel & Catering continues its positive momentum with an increase of €205m over H1 2016 or 67 developments. Industrial also recorded increases in both volume and value – 11 projects and €140m respectively. The biggest decrease in value terms was in Civil & Utilities at €443m and when analysed projects such as the €200m Vartry Water Treatment Plant in Co. Wicklow, the €160m Waste to Energy Facility in Co. Cork and the numerous Solar Farms in Co. Wexford all submitted for planning in H1 2016 go towards explaining the decrease.

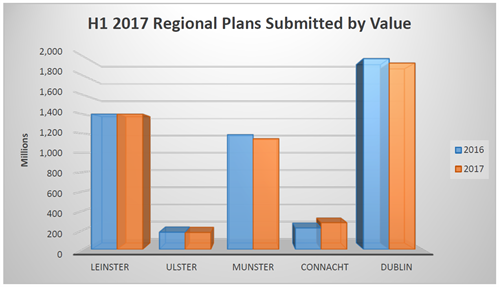

An analysis of the plans submitted by Region in volume terms reveals the continuing trend of activity increases in Leinster and Co. Dublin, with Connaught (-94), Munster (-45) and Ulster (-9) recording decreases over the same period last year. However, in terms of values the outcome is static, which suggests that in Connaught, Munster and Ulster (ROI) the individual developments are of a higher value versus the comparable period in 2016.

The full CIS Q2 Cosntruction Market Review will be ready later this week. Email [email protected] for a complimentary PDF copy OR call 01 2999 239.

Download CIS reports by clicking the button below.

Download CIS reports by clicking the button below.