Construction Information Services (CIS) collects, tracks and monitors key and major construction projects across Ireland. Our experienced research team, through their verification and updating of projects from early planning right through to on-site stages, provide us with construction activity statistics which supports the continuing momentum and positive sentiment being experienced by the Industry. The following is a condensed overview of activity for the Irish Construction Sector in Q1 2017 and what’s in the pipeline, as derived from our Q1 2017 Report.

The overall analysis of activity at Planning Submitted, Granted and commencing On-site overall is fairly static for Quarter 1 and it is appearing to remain the same for Quarter 2, based on April and May activity.

Overview of Current Republic of Ireland activity

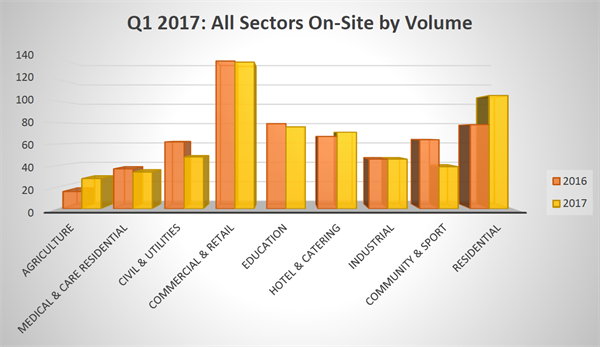

- The number of major projects moving on-site in Q1 2017 remains relatively static at 584

- The Value of all construction projects which commenced on-site in Q1 2017 in the Republic of Ireland was €1.4 billion

- This represents an overall decrease of 30% when compared to Q1 2016.

- However, when looking at construction values, the scale and mixed on construction has to be taken into account and much of this decrease in value can be attributed to the two major road schemes – N25 and M11 (totalling €675m) which started on-site in Q1 2016.

- All regions have experienced a drop in the value of projects on-site with the exception of Connacht.

- Dublin has the largest share of the market at 37%, with Leinster at 26% and Munster at 20%

- Residential is the largest sector for the period with 23% market share, followed by Commercial and Industrial

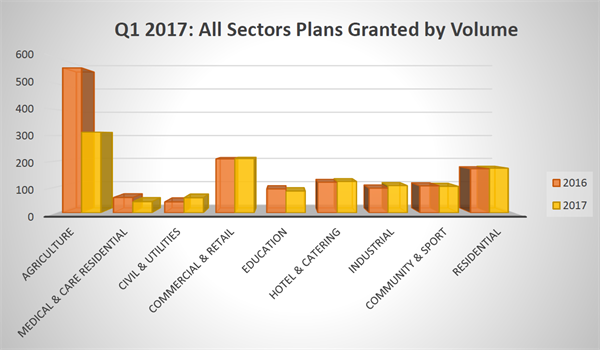

Future Pipeline activity – Plans Granted

- The volume of projects Granted planning in Q1 2017 was 1,207, down 17% when compared to the same period last year.

- All sectors have experienced a drop in values with the exception of Civil & Utilities, and Hotel & Catering.

- All regions have experienced a drop off in activity apart from Connacht which has shown a 77% increase in value, albeit off a low base.

- Much of the reduction can be explained by Agricultural projects where only 313 projects were granted planning in Q1 2017, as compared with 561 in Q1 2016.

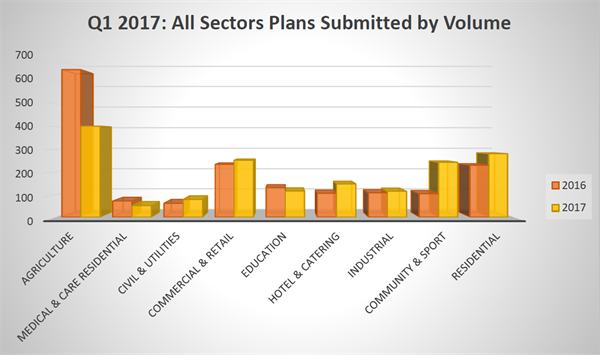

Future Pipeline activity – Plans submitted

- There was a marginal decrease in the number of projects Submitted for planning based on Q1 2016 levels, from 1,692 to 1,682.

- Once again the value of projects has also fallen by 29% in the period, with only Hotel & Catering, Industrial and Community & Sport showing positive increases.

- On a regional basis only Leinster and Connacht are in positive territory for the quarter.

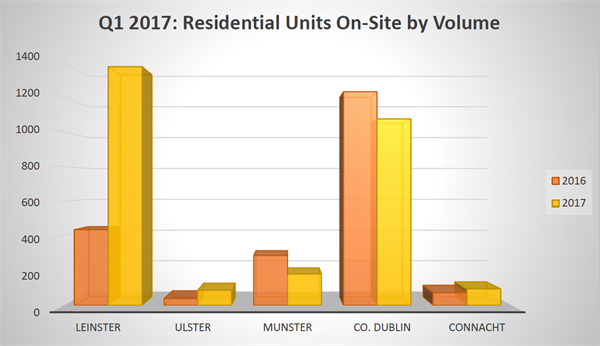

Q1 2017 activity in the Residential Sector

- Activity in the sector at all three stages continues to increase year on year.

- However, the number of developments which commenced on-site increased by 34.6% to 105 schemes and this represents in excess of 2,800 units for Q1 2017.

- While the number of applications Granted permission increased by just 2 over Q1 2016, but the number of units involved decreased by 620 to 3,280 units and this represents a drop in value of €113 million.

- There were 281 residential planning applicationsor (5,300 units) submitted in Q1 2017, up 22.2% on 2016.

- The buoyant self-build market saw 900 projects commence in the first quarter compared to 600 in Q1 2016.

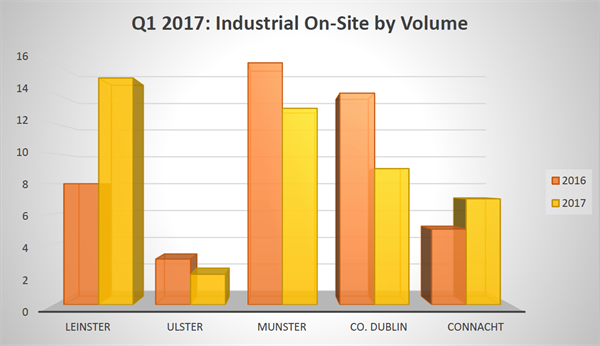

Q1 2017 activity in the Industrial Sector

- The number of projects commencing construction in Q1 was the same as 2016, however, there was a decrease of 23% to €210 million in the value of projects, which is as a result of the number of Data Centres which commenced construction in Q1 2016.

- While the volume of projects granted planning for Q1 2017 increased by 10, the value of these has fallen 60% on the same period last year. Total value of plans granted is just over €113 million. Only Connacht and Ulster have shown an increase, albeit from a low base.

- The volume of projects submitted for planning in Q1 2017 increased by 7% to 114 over Q1 2016. With Munster and Leinster represent the main activity in the sector. The value of projects submitted for planning increased by 46% to over €210 million for the period, with the Film Studios in Wicklow accounting for a large proportion of this increase.

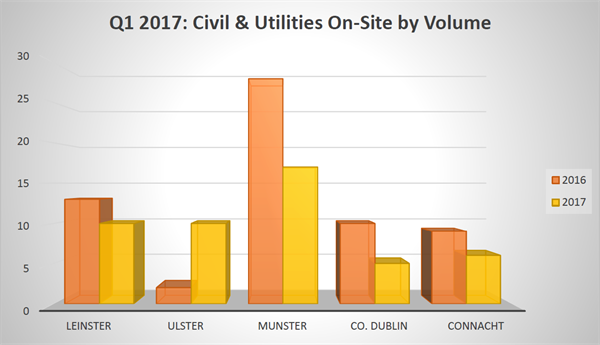

Q1 2017 activity in the Civil & Utilities Sector

- The number of project proceeding to On-site drop by 23% or 14 in Q1, with values dropping also by €744 million, which was due to the two large road schemes previously mentioned in Wexford which began in Q1 2016

- The Dublin Airport Runway which was granted permission in Q1 2017 represents over 50% of the value of the projects in the period. This, coupled with the large number of solar farms granted permission has helped ensure high project value of €572 million, up from €24 million last year.

- While the Planning application numbers increased by 17 in the Quarter to 78, the value of these projects decreased to €112 million or 58% owing to the mix of projects involved, which included 22 Civil, 46 Utilities and 10 Transport projects submitted.

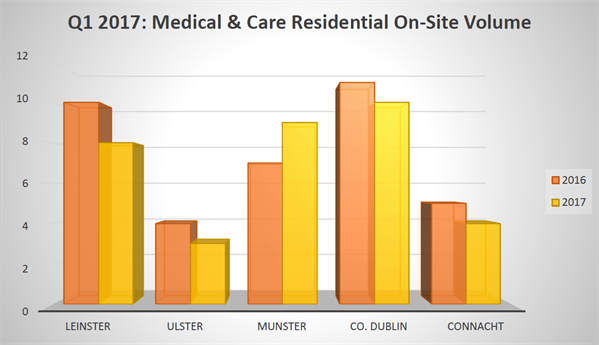

Q1 2017 activity in the Medical and Care Residential Sector

- Again, the number of projects moving to On-site is on par with Q1 2016, however, the value of these projects – €77 million represents an increase of 83% on Q1 2016. The new €25m Radiation Oncology Centre in Cork represents the bulk of the growth in the sector in Munster, while the €20 million Nursing and Sheltering Housing Campus Development in Galway makes up nearly all of the Connacht total.

- CIS made an adjustment to the Q1 2016 figures as two nursing home projects totalling €27 million which had started in Q1 2016 have subsequently been postponed and these sites have also been put up for sale.

- The volume of Granted planning permission in Q1 2017 is down 27%, again with values remaining almost static.

- The volume of projects submitted for planning in Q1 2017 has fallen from 71 to 51 in the first quarter when compared with the same period last year, however, values have remained static at €125 million.

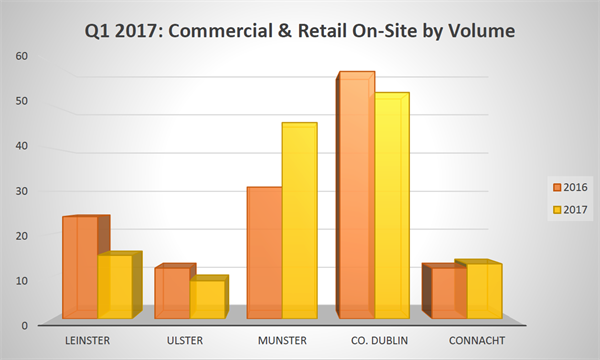

Q1 2017 activity in the Commercial & Retail Sector

- In this sector activity has remained static across the three stages being covered. The number of developments commencing On-site remains at 137 as per Q1 2016 and values also remain the same. Dublin continues to be the strong performer in this sector, however, Munster now represents 36% of On-site activity compared to 21% in Q1 2016.

- The projects of note are the €67 million Frascati Shopping Centre redevelopment which accounts for almost 50% of the Dublin market and could skew the figures somewhat. The €40m Bishops Quay development in Limerick makes up the bulk for the Munster region.

- Of the 137 projects which went on site in Q1 2017, only 32 were new builds with the remainder represented by major Renovation/Refurbishment, Extension or Change of Use.

- In terms of plans Granted, it is static at 209 projects, however, once again values are down to €220 million from €513 million on the corresponding period last year. The variance can be attributed to 14 major developments granted permission in Q1 2016.

- The volume of projects being submitted for planning increase by 8% over Q1 2016, however, the value of these projects in down significantly to €255 million from €786 million in 2016, which can be attributed to for example the €180 million Liffey Valley Extension submitted in Q1 2016 and subsequently refused permission for the carpark element, which has resulted in the entire development being put on hold.

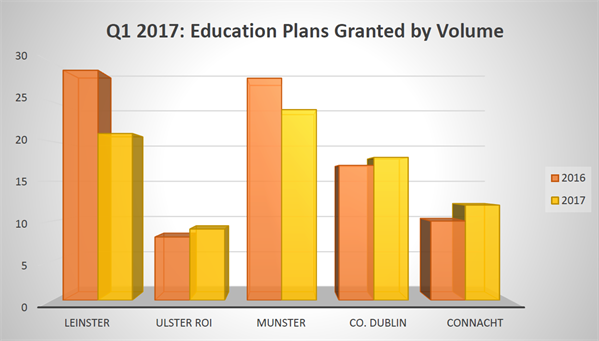

Q1 2017 activity in the Education Sector

- Similar to the other sectors the number of commencements to On-site is down marginally – 4%, with values down 39% to €88 million.

- The sectoral value decrease is mainly due to the Trinity Business School enabling works commenced in Q1 2016 with main construction commencing in Q3 2016.

- In term of Granted permissions, numbers and values are also down on Q1 2016 – 9% and 51% respectively.

- The number of projects submitted for planning is down 12% to 114 and values are down significantly to €57 million from €163 million in Q1 2016

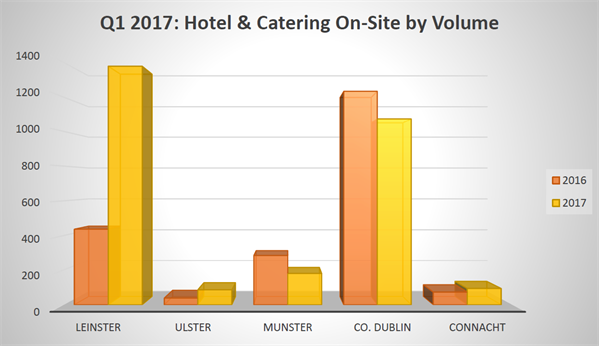

Q1 2017 activity in the Hotel & Catering Sector

- The Hotel & Catering sector, which includes Student Accommodation projects continues to perform strongly with an increase in the value of projects on-site of over 70% to over €230 million.

- Over €150m of this total is represented by student accommodation where more bed spaces (2,867) began construction in Q1 2017 than the total number of bed units (2,391) constructed for the whole of 2016.

- The number of plans granted and values increased by 3% and 12% respectively when compared with the same period last year.

- A 146 projects have been submitted for planning in Q1 2017, up from 105 in Q1 2016. All regions have experienced an increase in the number of projects in the quarter compared to the same period last year.

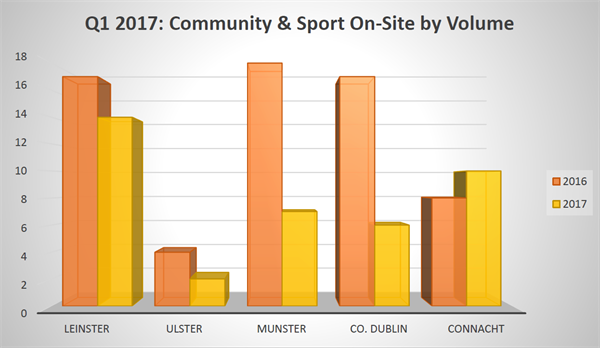

Q1 2017 activity in the Community and Sports Sector

- The value of Community and Sport projects moving to On-site in Q1 2017 increased to over €80m from €28 million last year, but most of this value can be attributed to the Curragh Racecourse redevelopment where enabling works have begun for the €65m project. The actual number of projects involved decreased by 39% to 40 projects.

- The volume of projects granted permission was relatively static at 102 when compared to Q1 2016, however, the values where down 80%, which can be attributed to the €230 million Centre Parcs development in Q1 of last year.

- The new Capital Sports Programme has witnessed a surge in planning applications in Q1 2017 when compared with Q1 2016. Over 240 planning applications have been received in the hope that their projects will receive capital funding. The estimate construction value of these projects is €120 million.

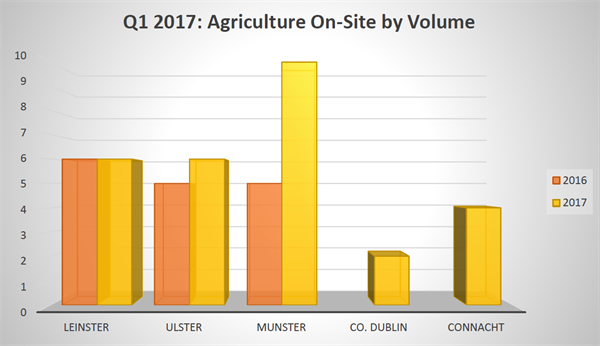

Q1 2017 activity in the Agriculture Sector

- The number of projects which have moved to on-site stage has increased by 75% in Q1 2017 compared to the same period last year, albeit from a very low base.

- The future for the sector is not positive as all regions have experienced a drop in the number and value of projects granted planning. The sector is down 42% in total with the Munster region almost halving in value.

- The volume of projects submitted for planning is also down significantly to 400 projects from over 650 in the same period last year.

Conclusion

CIS focused on the volumes of projects at each stage and the underlying trends are for each region and sector, as major projects can often skew the results in terms of values and give a misleading picture of what actually activity is on the ground.

While overall activity at the three stages covered – Applications, Granted and Commencements for the first 5 months of 2017 is static on a comparable basis with the same period in 2016, the increases experienced in 2015 and 2016 are maintaining the positive momentum within the industry. Our initial concern is the apparent levelling off of new applications entering the pipeline.

Some of this could be attributed to the underlying concerns regarding the uncertain impact of Brexit, the many challenges which still face our industry in terms of infrastructure, funding, manpower, etc. which is creating uncertainty over investment decisions and barriers for doing business for the construction industry.

Download CIS reports by clicking the button below.

Download CIS reports by clicking the button below.