What Does The Future Of Data Centres Look Like In Ireland?

In today’s rapidly digitising world, the development of Data Centre Infrastructure is vital for Ireland’s future economic success. The sustained development of data centres (DC’s) is critical to our country’s economy, as it offers enterprise, skilled employment, opportunities, and construction jobs. In this sector, it is important consider Ireland’s respected global reputation for DC enterprise but also how we may attain a sustainable approach towards planning and construction methods to keep activity in this flowing in the coming years. As a result of the ongoing global pandemic, the demand for data capacity and web-enabled services is at an all-time high, keeping Ireland firmly in a position for potential growth.

Through the series of lockdowns from the start of 2020, Ireland has shown continuous resilience throughout the shift to working from home, online learning and reliance of online web services and information. It evident that our digital, communications and data centre infrastructure has been sophisticated enough to ensure Ireland stayed well connected from the start of the pandemic crisis. This year, we find ourselves mitigating through hybrid working structures to ensure public health safety in our institutions, workplaces and venues by minimising our movement to lessen the spread of the Corona virus and variants. Ideally, data centre development will cater for the advancement of our digital infrastructure to keep up with these lifestyle changes. However, there are ongoing concerns underpinning the environmental impact of data centre development and the possible implications which may affect Ireland’s electricity supply.

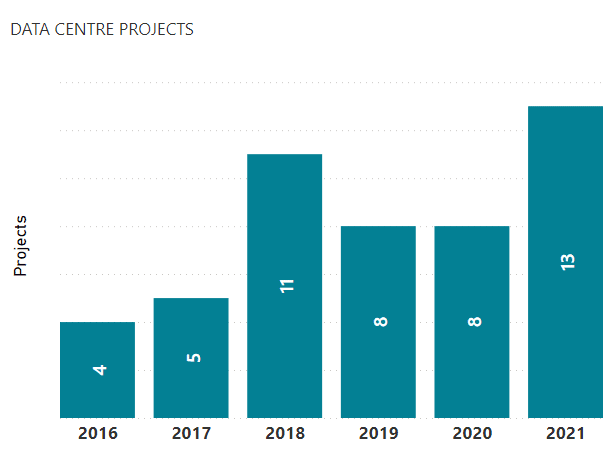

From my time as a researcher overseeing Industrial and Infrastructural projects here at CIS, I’ve noted that although investment remains high in this sector, there are a few interesting trends emerging from the last 12 months. [Figure 1] Construction Information Services (CIS) captured activity on a total of 31 Data Centre Projects representing a shell & core value of €1.797 Billion, which equates to 1,539,990 Sq.m Floor area coverage. I will look to explore both the planning and construction output in the DC sector but also shed light on some of the economic, social and environmental factors influencing construction activity.

|

|

Volume of Plans Submitted For Data Centres (2016 –2021) Figure 1) This graph shows an upward trend in the number of planning applications being submitted for Data Centre Developments in the Republic Of Ireland which may indicate long term investment – Click here for an interactive report – Open in Power BI

|

What is the Outlook for 2022?

In 2022, the Data Centre sector in Europe is set to continue to expand at a rapid pace. However, the EU’s response to the climate crisis may heavily influence the development of the sector requiring data centres to reach net zero targets by 2050 as part of the green deal. Energy supply is an ongoing issue in Ireland. In Q4 2022, Eirgrid imposed a moratorium causing a sudden halt to data Centre activity in the Dublin area. The moratorium has been brought about amidst concerns on the current data centre energy consumption which is 11% of Ireland’s overall electricity usage. The figure (11%) has been projected to grow to at least 23-30% by 2030 which Eirgrid says may place a disproportional pressure on the National Grid resulting in energy shortages and black outs.

|

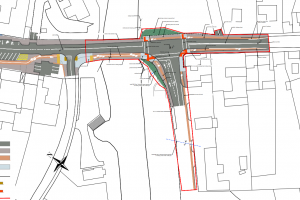

| Figure 2) This map zooms in on all Data Centre activity (from plans submitted to site completion) in the Greater Dublin Region in ROI. CIS can determine that data centre development is mainly concentrated in the Dublin Area, specifically in the areas of Clondalkin, Blanchardstown, Lucan & Swords.

|

Construction activity captured by CIS suggested that the highest activity was heavily concentrated in the Greater Dublin Region, which may support the above observations. [Figure 2] For example, 7 out 12 Data centre applications submitted in the past 12 months were based in County Dublin. However, plans have now been submitted for large scale data centres in counties Galway, Mayo, Clare, Cork and Meath respectively. Plans have also been granted for a new 30,138 sq.m Apple Data Centre in County Galway. As more counties see the green light of DC applications, it is possible Ireland will see a fairer distribution of opportunities, enterprise and resources.

Given the current scarcity of energy supplies and the strain on the national grid, the continued investment in renewable energy should not only be outlined in the early business case, preplanning and pre-construction stages of data centre development but also considered by suppliers. There is uncertainty on how planning regulations may progress as the matter of grid pressure is debated between policymakers and stakeholders.

From observation, it is imperative to view data centre development in not just one dimension as there may be a market to develop Ireland’s renewable energy sector as well. CIS has noted that most Data Centres have plans to generate power through substations onsite and through alternative methods. Data centres developers Amazon have heavily invested in Wind Energy in Arrderroo, County Galway and also heat generation in the Tallaght region of Dublin. Fortunately, Ireland is not just the Silicon Valley of Europe and there is unearthed potential to generate green energy in Ireland’s wind, solar and off shore capabilities. The future of construction and investment in this sector may be more heavily hinged on answering to climate change action and sustainability plans more than ever before.

There is continued investment on the horizon for this sector as companies such as Amazon, EdgeConneX, Microsoft and Apple are continuing to pursue planning in Ireland. Irish based Echelon Data Centres recently announced a financing agreement of €855 million to facilitate the construction and completion of it’s four data centres planned in Ireland. These four data centre projects will have the capacity to generate an enormous 390MW of power from the renewable energy sources on site. [Figure 3] Cost competitiveness is an overruling factor affecting the success of construction within the Data Centre sector. Construction within the industrial sector is expected to be challenging with cost-effectiveness, Covid 19, Brexit and bottleneck chain supply issues likely impacting into the coming year. The inflation of construction supplies, transportation of goods, energy, taxes and property availability all play a heavy hand in the expansion of warehousing, offices data centres and research facilities.

|

| Figure 3) A CGI Image of Echelons Data Centre Development in Arklow, Co. Wicklow, which is one of four developments in Echelons Data Centre Portfolio in Ireland. Image Echelon / Crag Digital |

Conclusion

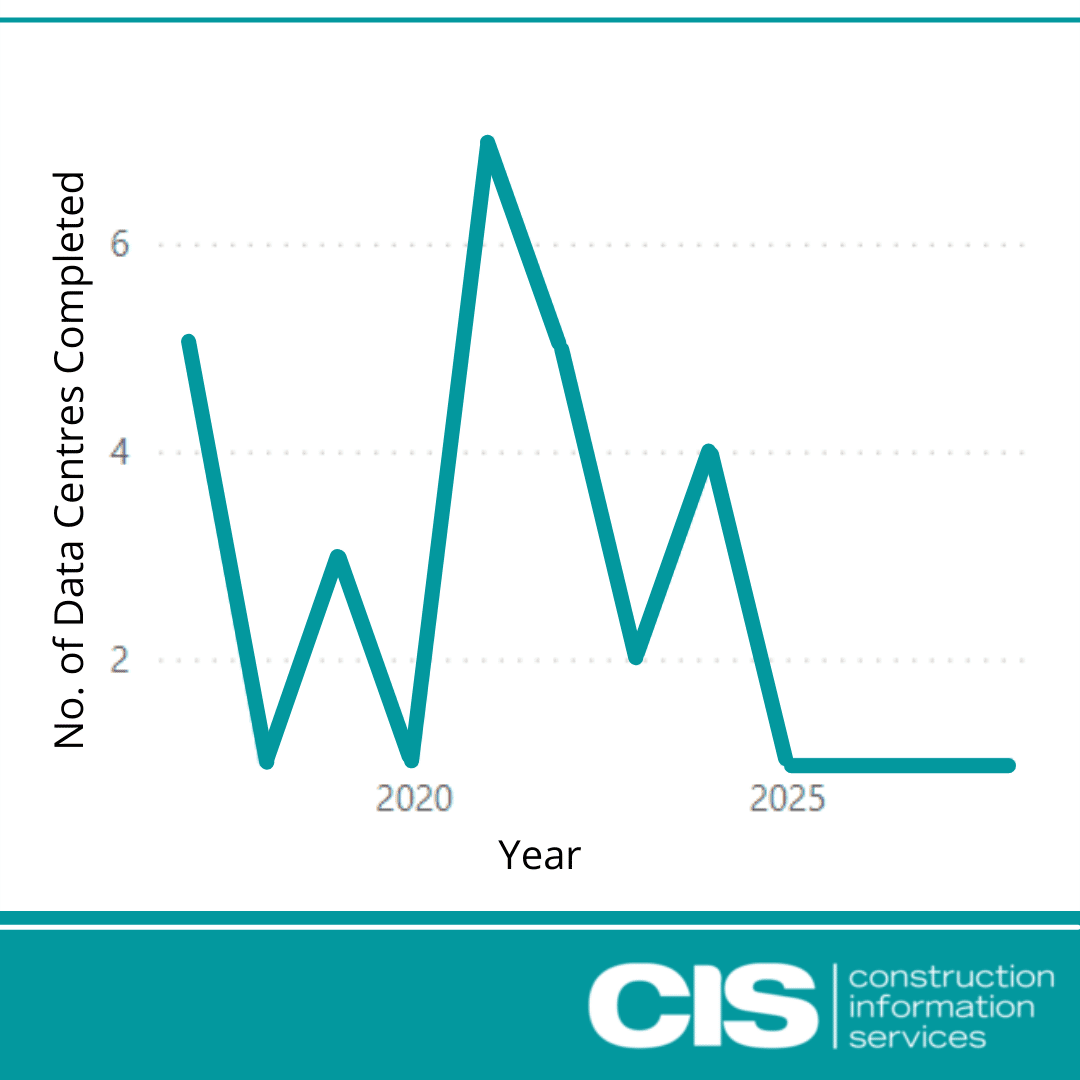

With data consumption and the demand for smart technology at an all-time high, the continued development of data centres is critical to the economic success of our country. For the year ahead, Ireland’s ability to adapt and respond to issues such as globalisation, green energy and economical constraints is a determining factor for the growth and continued success of this sector. [Figure 4 ] Government policy in the forms of funding and regulation can hopefully help mitigate the economic challenges in this sector in the coming year.

|

|

Projection of Completed Data Centres (2018 –2028)

Figure – This graph shows the projection of completed data centres over a decade. Project completions are expected to trend downwards in 2023 and 2024 based on information captured by CIS in the last 12 months (dated Jan 2022). Click here for an interactive report – Open in Power BI

|

From planning to completion, CIS monitors and tracks all construction activity. Please do not hesitate to contact us at [email protected] if you have any questions about this study. By clicking here or emailing [email protected], you can also join up for a no-obligation free trial with full demonstration of CIS Online.

Download CIS reports by clicking the button below.

Download CIS reports by clicking the button below.