As a CIS researcher, I have observed many interesting trends in the education sector, especially over the course of the pandemic. Within in my role, I primarily oversee research in the educational, infrastructure and industrial sectors, while also monitoring capital expenditure projects. In this piece I will be focusing on the education sector highlighting planning volumes, on site activity and delivered projects. I will identify and cover the key drivers and trends in primary and secondary schools, third level institutions and student accommodation schemes.

Primary & Secondary Schools

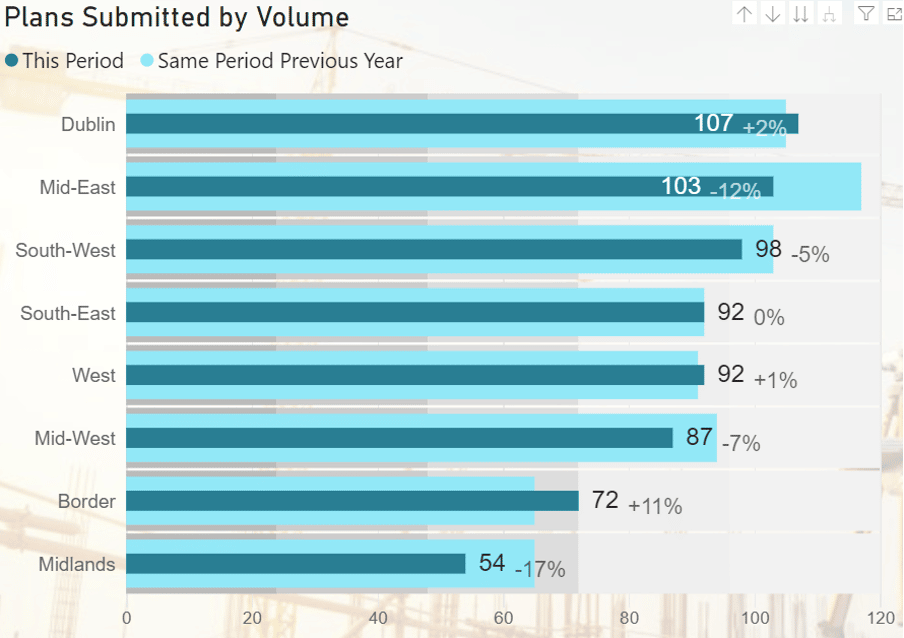

In 2021 there was a general slowdown in the volumes of planning applications for primary and secondary school developments being submitted and approved across 3 provinces. The highest concentration of applications is situated in the Dublin and Mid-East Region. The lowest activity was recorded in the West, Midlands and Border regions. [Figure 1]

On a positive note, in 2021 there was substantial increase in the number of primary and secondary school projects completed, adding approximately 1,903 classrooms, which is a 41.4% increase on volumes completed in the previous year. Notable school projects brought to completion this year, were the €30m – Carrigaline Education Campus in County Cork, the €20m – Clarin College Development in Newford, County Galway and the €19.2m new build for Swords Community College in County Dublin.

Third Level Institutions

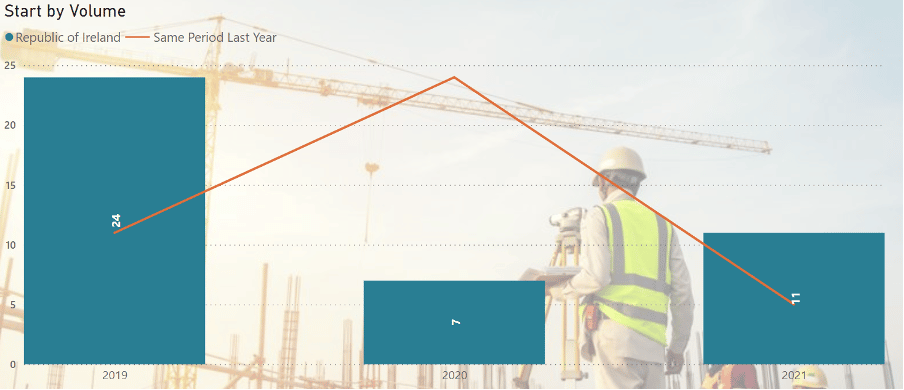

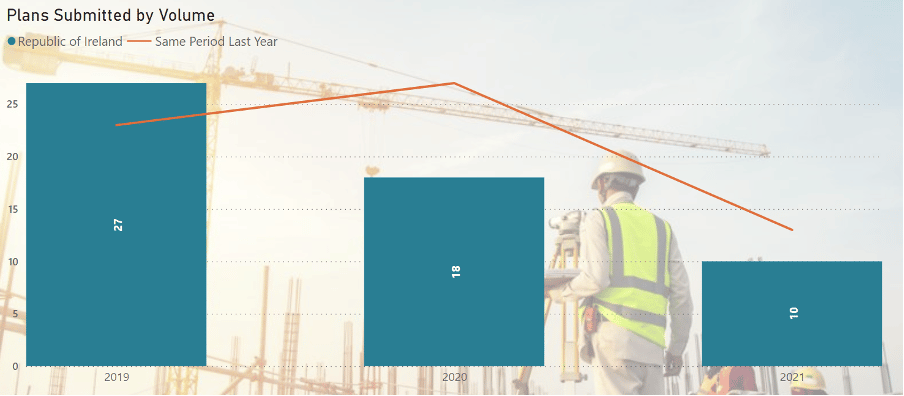

In the third level sector, there has been a slowdown in the planning pipeline, which may be reflected in the closure of campuses across Ireland leaving many colleges and campus communities vacant for the vast majority of the pandemic thus far. [Figure 2]

Figure 2 – shows an upward trend of schemes starting on site in 2021.

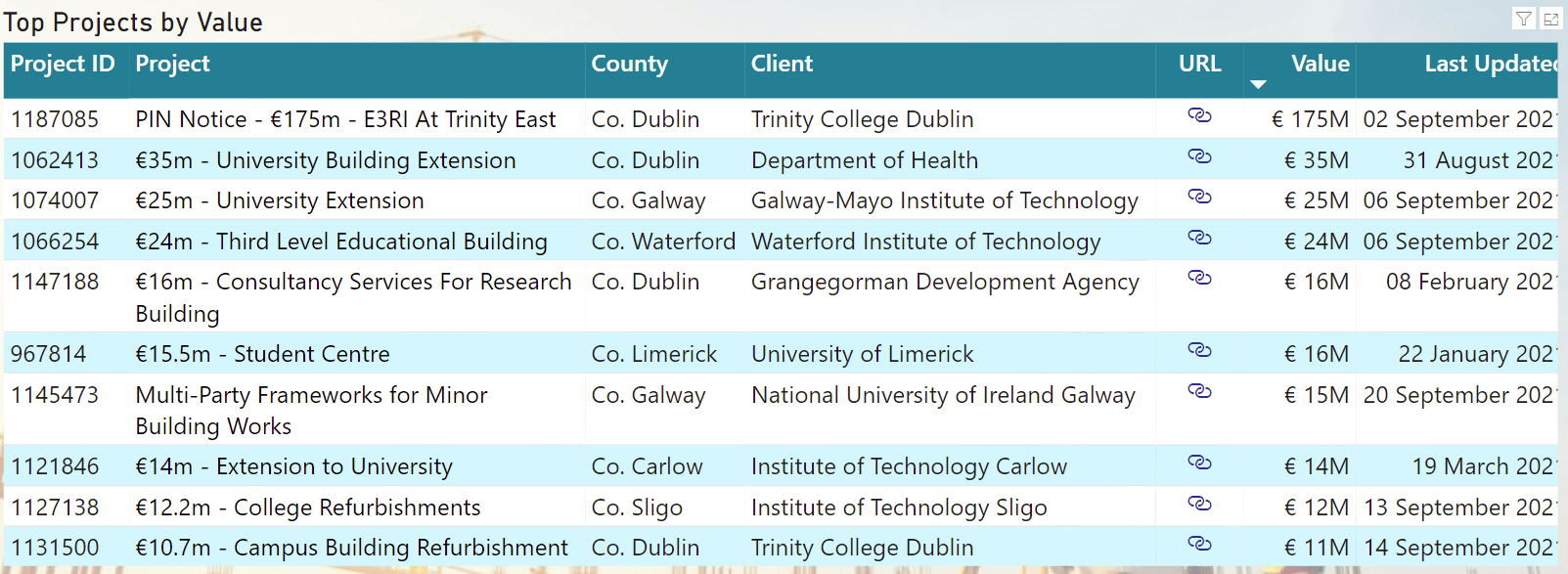

That being said, a recovery for third level institutions seems promising, with a very notable increase in the areas of procurement and construction. There is approximately €739m worth of college projects at a tender stage which is a healthy 4.8% increase from what was recorded in 2020. [Figure 3] Tenders are currently being sought for a €25 million extension to Galway Mayo Institute of Technology in County Galway. This project is part of the €200 million NDFA Higher Education PPP – Bundle 2. [Figure 4]

Figure 3: Shows a snapshot of the top third level projects out to tender.

Figure 4: A visualisation of the new extension (5,550 Sq.m) for Galway Mayo Institute of Technology by Taylor McCarney Architects.

Student Accommodation

We have noted a slow down in the planning pipeline for student accommodation projects with a 4.3% decrease in the number of schemes granted planning across the overall region. However, despite the downturn of output recorded, a total of 21 projects were completed this year. The majority of construction activity is concentrated in the Dublin and South West regions. It might be possible to see a pick-up in these numbers as students return from prolonged remote learning as the pandemic restrictions are eased. [Figure 5]

Figure 5: This figure shows a downward trend in the number of projects submitted for student accommodation across the whole ROI region over the past 36 months.

From this research, it is evident that Covid 19 and it’s after affects have inflicted significant challenges within the education sector. Despite this, there are many positive indicators here to signify a stabilisation in construction activity with many influential schemes continuing to move forward. It is hoped there will be more growth in 2022 with students returning to schools and campuses.

As a result of the economic uncertainty and movement of goods that has derived from the Covid-19 pandemic these past 16 months, CIS have observed significant delays now being felt within the education sector. Through constant engagement with our information sources, who work to deliver these vital construction projects across the country, the spiralling costs of and access to materials required for the schemes is now having a serious effect on the previously agreed costs and the delivery dates of these projects. We have encountered several examples where originally appointed contractors are withdrawing from contracts and schools/education boards being forced to re-issue tenders and/or approaching originally unsuccessful tenderers.

CIS monitors and tracks all construction activity from the point of planning to completion. If you are interested to know more about this analysis please do not hesitate to email me on [email protected] or at [email protected]. You can also sign up to a no obligation free trial of CIS Online by clicking here or emailing the team at [email protected]

Sharon O’Rourke

Infrastructure + Industrial Researcher

Download CIS reports by clicking the button below.

Download CIS reports by clicking the button below.