Positive Trends Point to Optimism

Overview

The erratic nature of the planning and construction activity during the pandemic years can render snapshot analysis meaningless when comparative periods include timeframes when the economy was in lockdown. While this report focuses on construction activity in Q4 2021 it is prudent to put this analysis in the context of annual activity trends to get a broader viewpoint on the overall health and direction of the construction industry.

In 2021, the overall value of planning activity, (plans submitted and plans granted), grew by 12% from 2020 to €38.5bn. This was a significant rise given that there had been a 3.7% fall in such activity in 2020. The biggest driver in these figures was the residential sector which represents 63%* of all planning activity and grew by 13.7% in 2021. Other significant movements in pipeline activity were a 22% fall in hospitality and a 21% fall in commercial activity. The industrial sector, which includes warehousing and data centres, rose by 24% reflecting lifestyle changes exacerbated by the pandemic.

Submitted

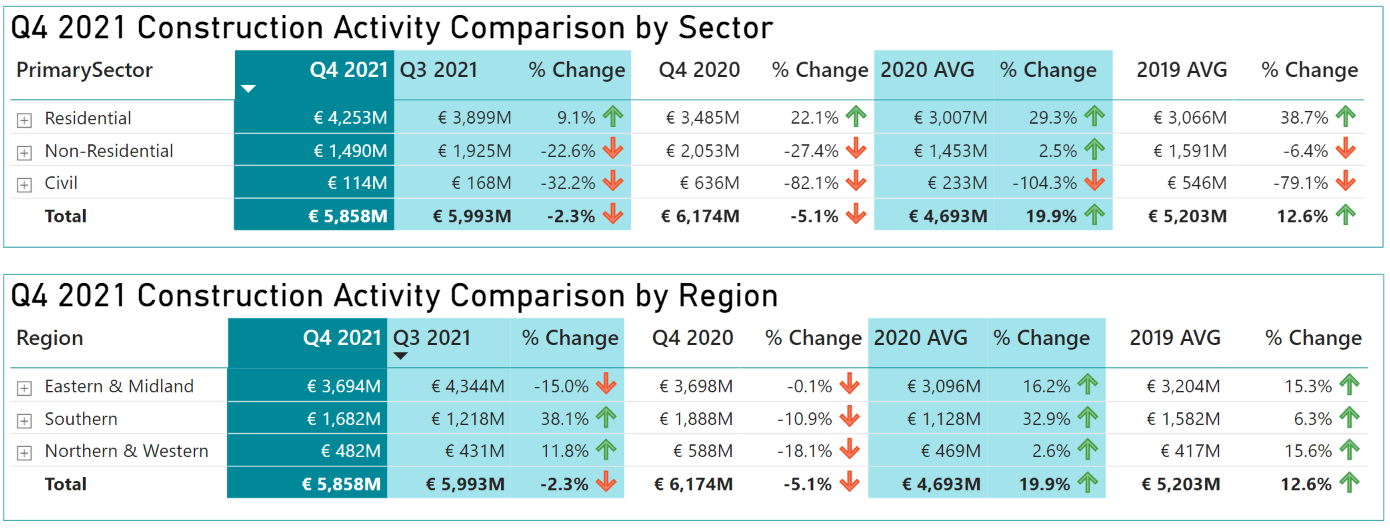

Volume of Residential planning applications rose by 1.3% but overall value of planning in quarter is up by 22% to €4.25bn compared to Q4 2020 while the number of units rose 38% to 22,000 from Q4 2020. Planning values rise in Eastern and Midland Region up 28% from same period last year. Conversely, non-residential applications saw values down 27% to €1.5bn from Q4 2020, with only the Southern Region increase the value of plans submitted (13% to €540m). Planning investment in all sectors declined from Q4 2020 except for the Education sector which remained steady and the Medical sector where investment rose by 140%. A total of 971 nursing home beds had applications submitted which is a 60% increase in investment to €178m from Q4 2020. Office and retail applications also saw a decrease – down by 35% by value.

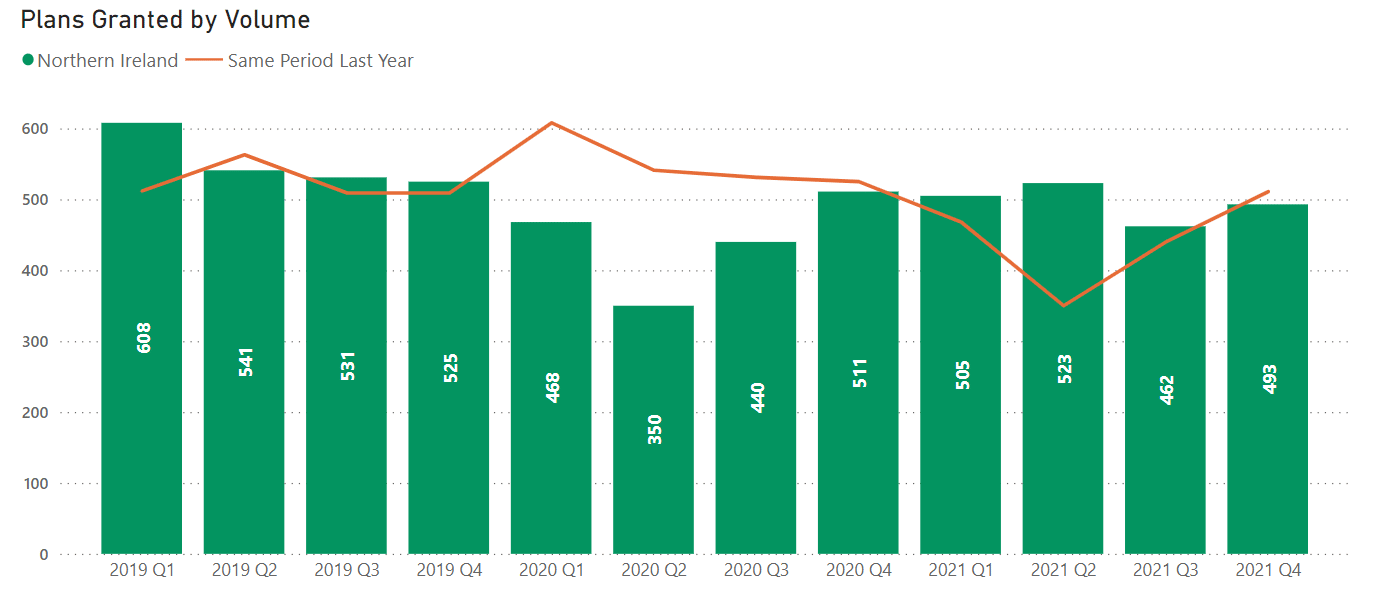

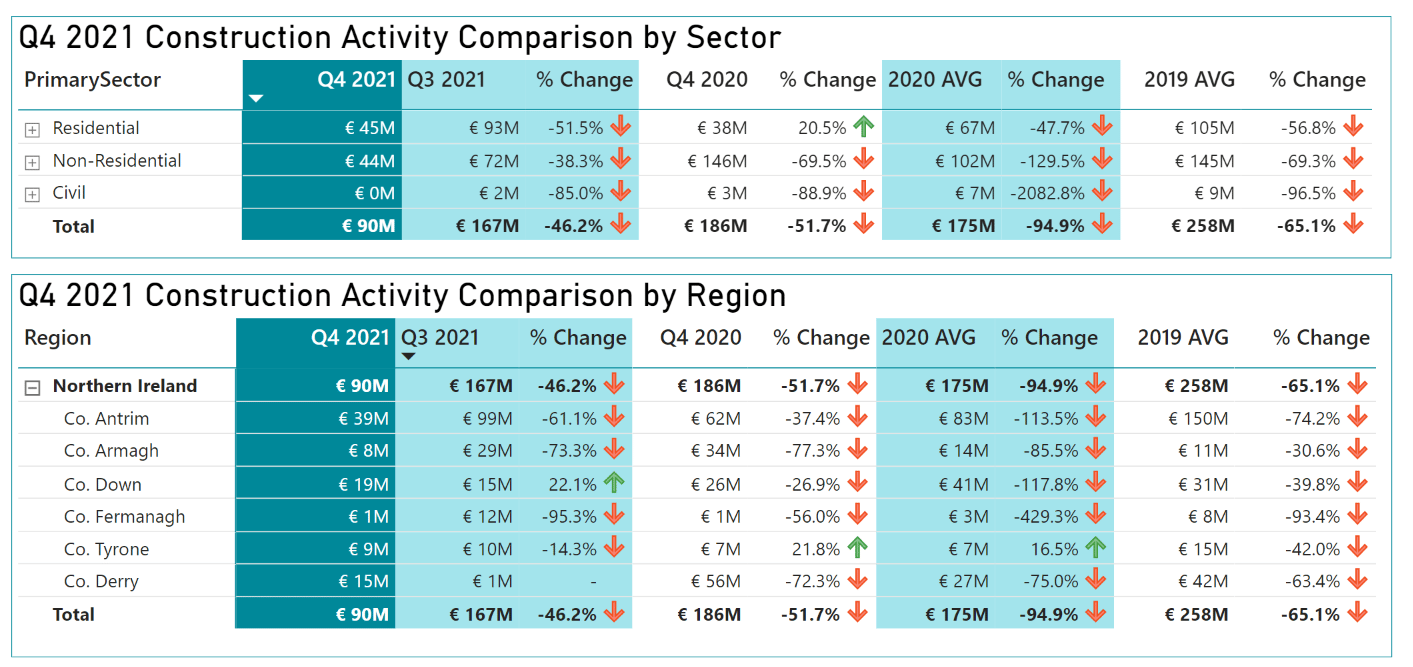

Planning activity in NI rose by just over 4% in 2021 to nearly £4bn but this follows a 34% fall in value in 2020 from 2019. The trends follow those observed in ROI with double digit growth in the residential and industrial sectors and falls in investment in the commercial and hospitality sectors.

Figure 1 Plans Submitted by Sector & Region

Granted

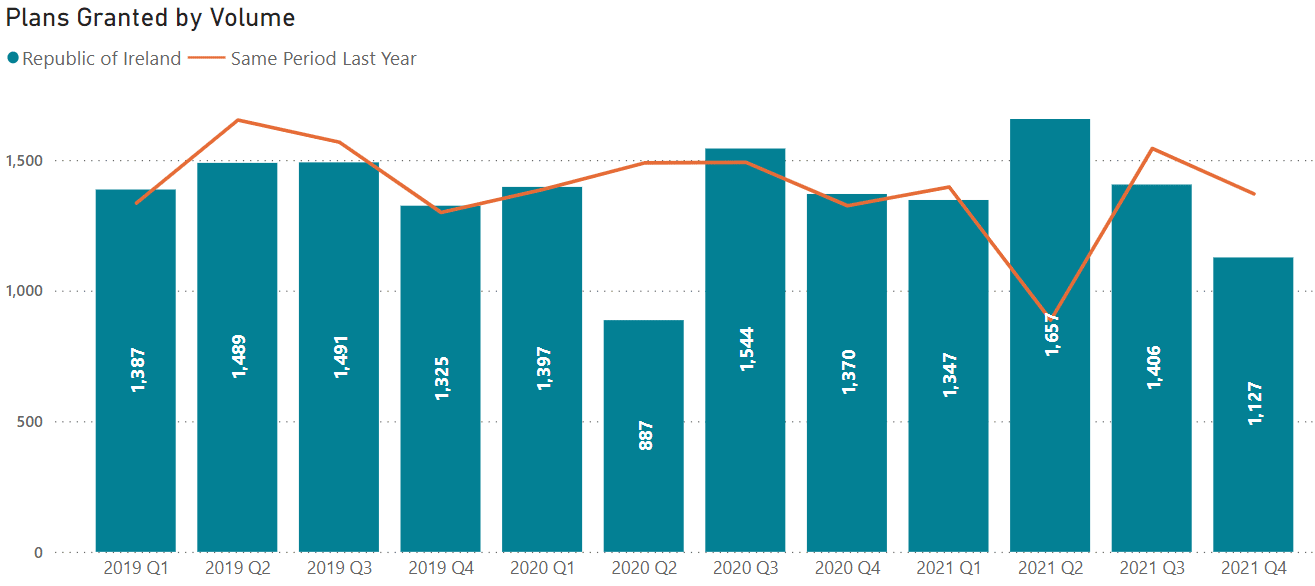

The value of ROI plans granted for residential applications rose 23% to €2.18bn from same period last year with 11.4k residential units were approved in Q4. One bed apartment units accounted for nearly 30% of all units granted. In the Eastern and Midland region, the number of units approved rose to 8,668 from 5,734 in Q4 2020 with the largest project gaining approval being a 1,592 unit Build to Rent development in Drumcondra (CIS ID: 1198506). Non-residential projects granted however saw a decrease of 21% over Q4 2020, with only the Industrial sector showed growth rising by 37% in planned investment. The largest project approved was a 64,550sqm Distribution Warehouse for Barola Capital DAC, while only 595 hotel bedrooms and 518 nursing home beds were granted planning in total across the other sectors (CIS ID: 1207595).

Figure 2 ROI Plans Granted by Volume

Figure 3 NI Plans Granted by Volume

Project Starts

Residential project starts saw an increase on the previous year, likely due to a relaxing of restrictions. Residential starts were up 55% on Q4 2020 with all regions showing increased on the ground activity except the Northern and Western region which showed a 27% decline from same period last year. A gross volume of 5,558 residential unit were underway with the largest project starting being €99m – Bakerhall Development, Navan for 544 units – 186 units have commenced on site (CIS ID: 1079772). Non-residential however saw mixed results with nationwide starts down 16%, despite starts in the Southern region bucking the trend with a 18% increase over Q4 2020. Hospitality sector saw the highest increase with a rise of 110% to €16m, compared to public sector starts in the medical and education sectors – which fell 42% over the same period last year. The largest non-residential project started was the €67m Horizon Logistics Park, Harristown, Co. Dublin (CIS ID 1134206). Northern Ireland activity on the ground rose by 17% to £850m with positive growth in the Industrial, Residential, Medical and Hospitality sectors.

Conclusion

While pipeline activity represents the mood and optimism of the economy the progression to on-the-ground activity is not always certain. Looking at project starts in 2021 (representing new project starts and excluding phase starts of ongoing projects), there has been a 26.7% rise in the value of project starts which more than offsets a 12.5% fall in starts in 2020. Again, the residential and industrial sectors lead the way with 37% and 42% rises in the value of starts over 2020.

If you would like to learn more about our research, feel free to contact the CIS research team by emailing research@cisireland.com or call +353 1 2999 200

Download CIS reports by clicking the button below.

Download CIS reports by clicking the button below.