Written by Tom Moloney, Managing Director, CIS

I am delighted to present Construction Information Service’s H1 2018 Construction Activity Report, which will provide a comparative analysis of project activity at Planning Applied, Planning Granted and Projects moving On-Site with the equivalent period in 2017.

As is widely reported the Irish construction sector is maintaining its momentum, increasing in confidence and activity is spreading to the regions outside Leinster and Dublin. This confidence is expected to continue given the Government’s commitment under the National Planning Framework 2040 with particular focus on infrastructure, housing, education and medical.

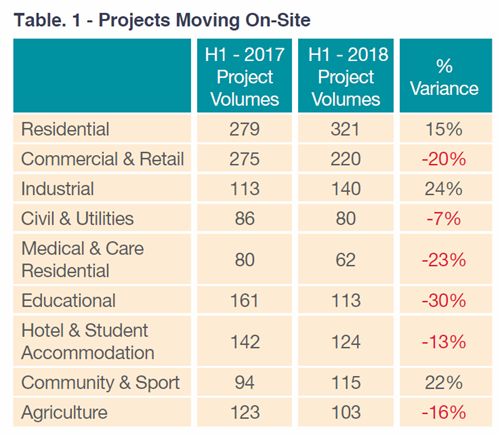

Based on our analysis the volume of projects commencing on-site construction (Table 1) has dropped in every sector with the exception of Residential, Industrial and Community and Sport.

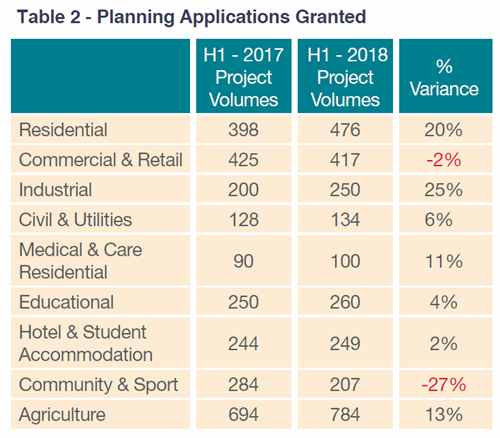

In examining the pipeline activity for projects being granted planning permission to proceed to either tender or contact awarded, our research demonstrates an overall positive picture (Table 2) with all sectors with the exception of Commercial & Retail and Community & Sport recoding increases.

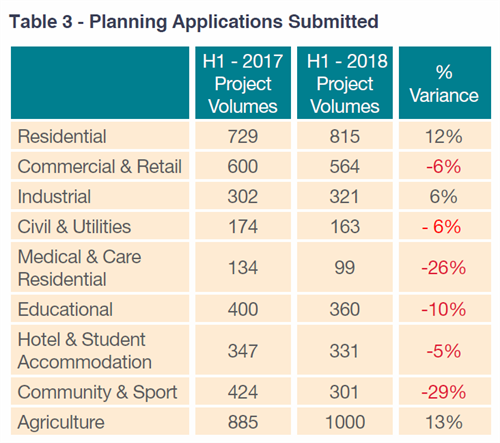

However, our comparative analysis with H1 2017 reveals mixed results in terms of the number of planning applications being submitted for approval (Table 3). Residential, Industrial and Agriculture are the only sectors to show positive increases.

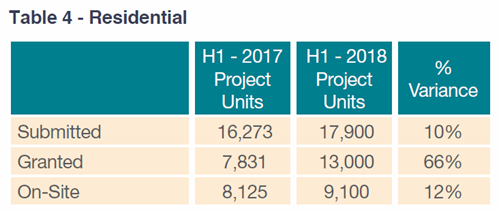

The Residential sector is continuing to draw the most focus in terms of media, Government, developers and contractors. While the sector continues to improve year on year from a low of when fewer than 8,000 units were built in 2013, the table (Table 4) below demonstrates the sustained increases at all three stages in housing activity, with still some way to go to achieve the 35,000 required to ease the current crisis.

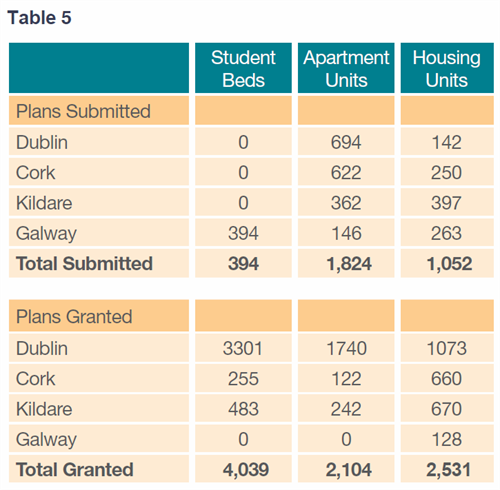

The Governments initiative to ease the housing crisis with the introduction of the Fast Track planning process for residential and student accommodation applications now has in excess of €1,372 million worth of projects in the planning system (Table 5).

The sustained increase in activity is evident in the above data, however, one anomaly of the residential statistics is the small decline in projects going on-site and being applied for in Dublin. This shows the increased development opportunities outside the capital since the recession as housing remains largely more affordable to first time buyers the further away from the capital’s city centre.

Looking at other sectors such as Civil & Utilities, with infrastructure being of high importance for the delivery of all construction projects, this sector will continue to be an area of growth over the next twenty years as outlined in the National Planning Framework. Given the nature and size of these projects getting them to On-Site stage will be slower initially.

The Industrial sector continues to be in a strong position to thrive in 2018 and beyond. Activity in this sector has been dominated by Tech Giants such as Microsoft, Facebook, Apple, Amazon and Google. Another area of impact on the sector is the alcohol producers. Large maturation warehouses and distillery developments such as Sliabh Liag, the Shed Distillery are being developed here.

The Education sector is dominated by the development at the Grangegorman Campus. Our Researchers are noting the year on year decline in project volumes since 2016. Funding and the impact of the liquidation of the Sammon Group have and will contributed towards the slowdown in the sector. Pre-fabricated buildings are being used as a temporary solution until funding is secured for permanent buildings and in some cases, schools are waiting many years.

Similar to the Education sector, funding is a major issue in the Medical & Care Residential sector. Due to the ongoing construction of the €1 billion New Children’s Hospital at St James’ Hospital, a large number of other medical schemes have been put on the back burner for the moment at least. Again, pre-fabricated buildings are being utilised in the medical sector. Recently, the HSE issued Pre-Qualification Questionnaires for the provision of a 60 bed Modular Ward Block for University Hospital Limerick.

In the Commercial & Retail sector, it would appear that activity across all three stages (applied, granted and on-site) have plateaued. The Irish office market is at a stage where the main priority is delivery of the existing large-scale projects under construction. It should be recalled that between 2014 and 2016 we witnessed large volumes of projects coming into the construction pipeline and commencing construction, particularly under the North Lotts & Grand Canal Dock SDZ planning scheme and the majority of these are now well into the construction phase.

The Hotel & Student Accommodation sector remains buoyant. In Dublin City Council area alone 79 hotels are in the pipeline. 35 of these are either at plans submitted or approved comprising a total of 2,961 bedrooms this year alone. A further 44 hotels comprising 3,903 bedrooms are at tender award or construction stage.

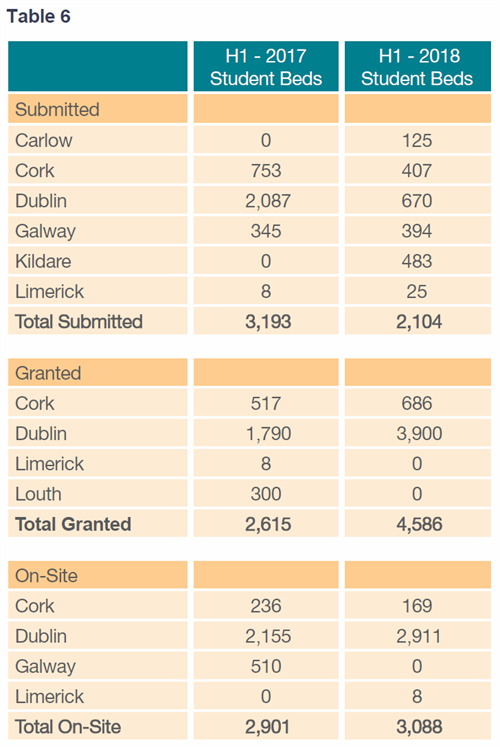

As highlighted in previous Construction Activity Reports, Student Accommodation is a lucrative area for developers. The followings analysis demonstrates the level of activity on a comparative basis (Table 6).

The construction industry has come through a period of restructuring since the collapse in 2009, has regained confidence and is once again an important pillar of the Irish economy. The industry and Government are working together to over come the continuing constraints hampering activity. The sector is still experiencing short supply of professional managers, skilled and unskilled trades and these coupled planning delays and raising finance are challenging and need to be overcome in order to maintain the current and future growth prospects for the country.

To request the full H1 2018 Construction Activity Report, click here

Download CIS reports by clicking the button below.

Download CIS reports by clicking the button below.