At CIS, our researchers have seen many trends come and go over the course of many years. Build-to-rent (BTR) communities or build-for-rent (BFR) homes are a type of home development that has remained popular in recent years, with a small share of the market but has the potential for rapid expansion. With growing housing prices and shortages, an increasing number of homeowners are considering these purposely built-to-rent single-family houses as a viable alternative to purchase, especially because the future for this sector is positive. In this article we will take a look at some data relating to the current BTR planning volumes, on-site activity and delivered projects, and how the sector has been performing over the past 5 years and following the pandemic.

Projects

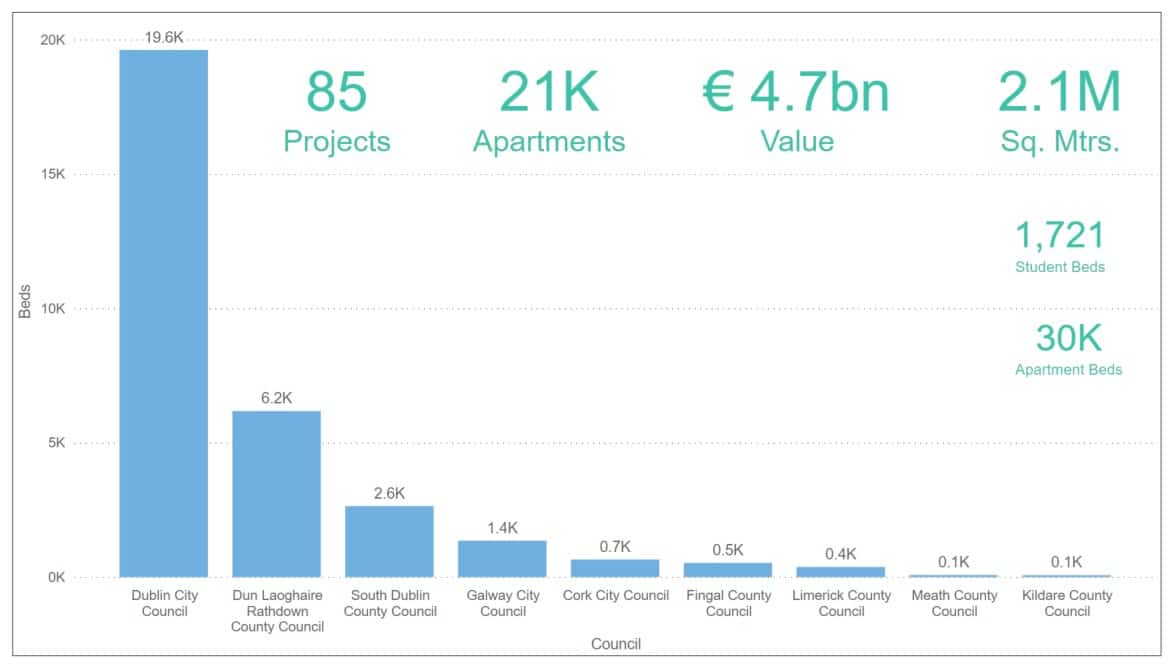

At the time of writing this report, there are a total of 85 projects at various stages in the BTR sector and a total value of €4.68bn. Movement on projects has increased considerably now compared when to when we were in the height of lockdowns over the past year. The current desire to increase residential construction and affordability has driven the current BTR schemes, a highly desirable and community-building endeavour. Currently, these projects consist of 29,777 apartment beds, which are spread across 1/2/3 bed apartments. It also includes 1,721 student beds which in itself lends itself to the issue of education accommodation particularly in Dublin.

Planning Authority

Dublin maintains the highest concentration of BTR projects, with Dublin City Council alone supplying a total of 18,793 beds. Dublin City also has the highest volume of BTR projects lodges They are also the highest proponents of student beds (819), followed closely by Dun Laoghaire-Rathdown County Council with 576 bed units. Rural cities show a lower demand for build to rent schemes with Cork, Galway, Limerick, Meath and Kildare Council’s only totalling 2,213 apartment beds.

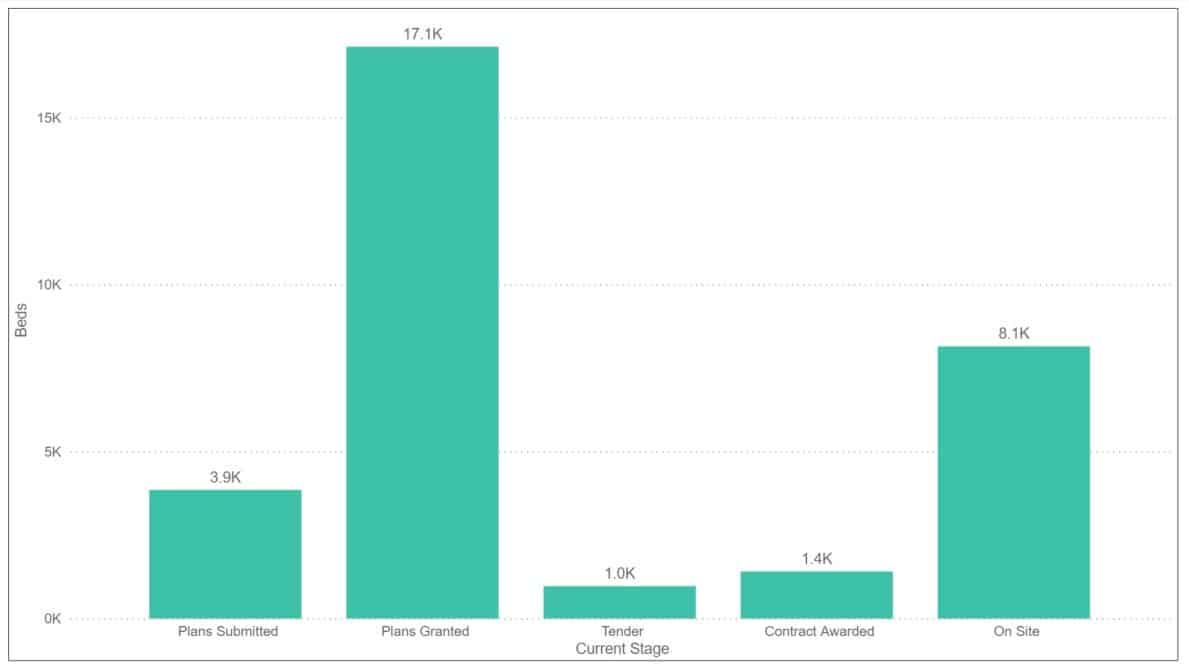

By Stage

Currently, there are a total of 25 projects on site right now which equates to 7,914 apartment beds and 235 student beds. Plans have been granted on a further 41 projects totalling 16,207 apartment beds and 910 student beds. Another 16 projects have now submitted plans and will be expected to produce an estimated 3,851 beds should they be granted permission by their local planning authority. Despite challenges with Covid-19 and supply chain, the construction planning pipeline remains strong for 2022.

Top Projects

Of the current projects, some are worth noting as key developments. An urban regeneration project of 376 residential units is taking place for Seagullpoint Limited and is valued at €320m which is currently on appeal (1091459). Plans have been granted on a €251m mixed use development on the Naas Road, Dublin (1073080). Finally, a €160m apartment development is in the works, granted permission by Dun Laoghaire-Rathdown County Council (1088440). You can sign up for a FREE TRIAL to receive the latest updates on these and thousands of other projects

Why Choose CIS?

From planning to completion, CIS monitors and tracks all construction activity. Please do not hesitate to contact us at [email protected] if you have any questions about this report. By clicking here or emailing [email protected], you can also join up for a no-obligation free trial of CIS Online.

Download CIS reports by clicking the button below.

Download CIS reports by clicking the button below.