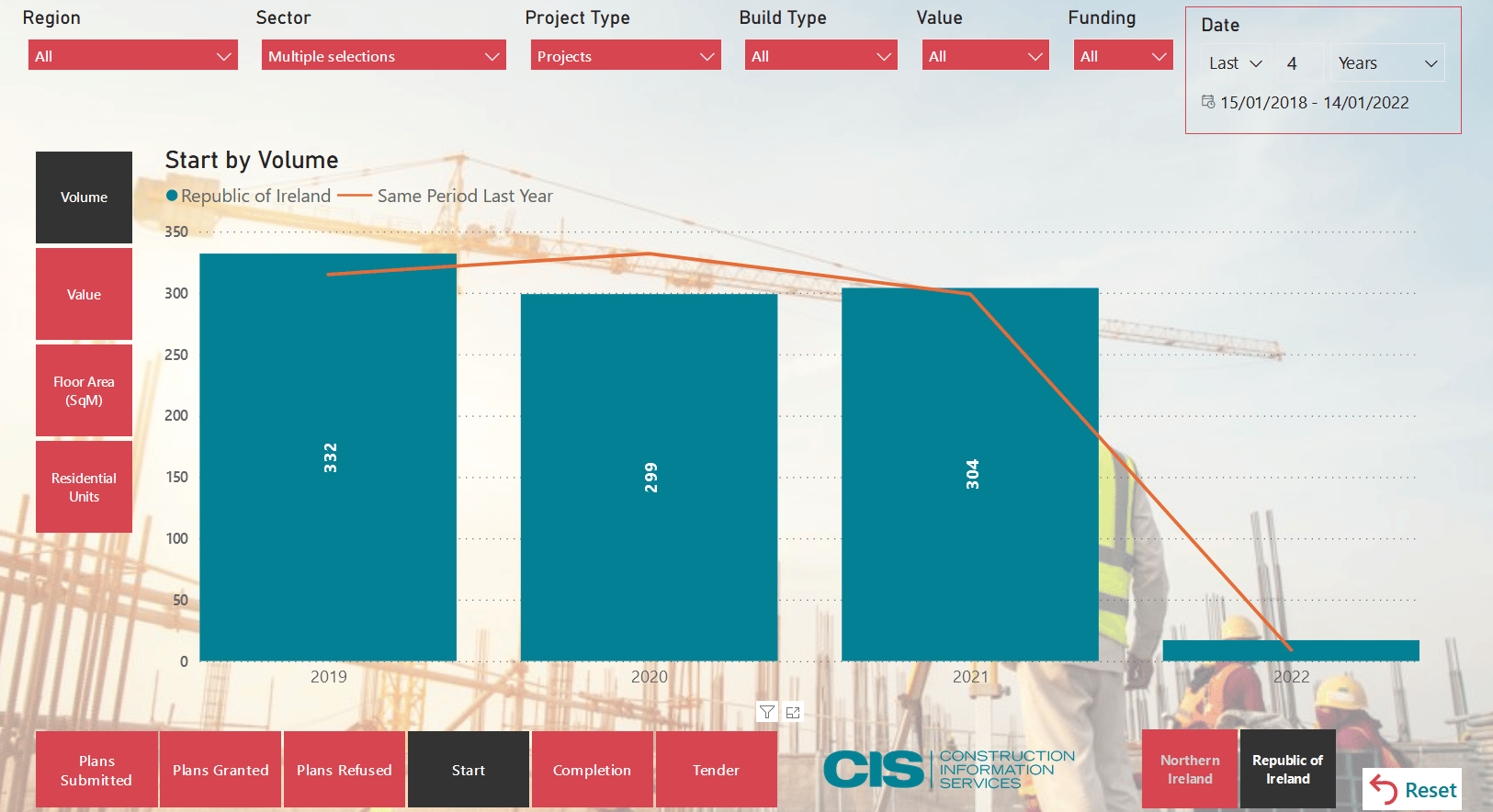

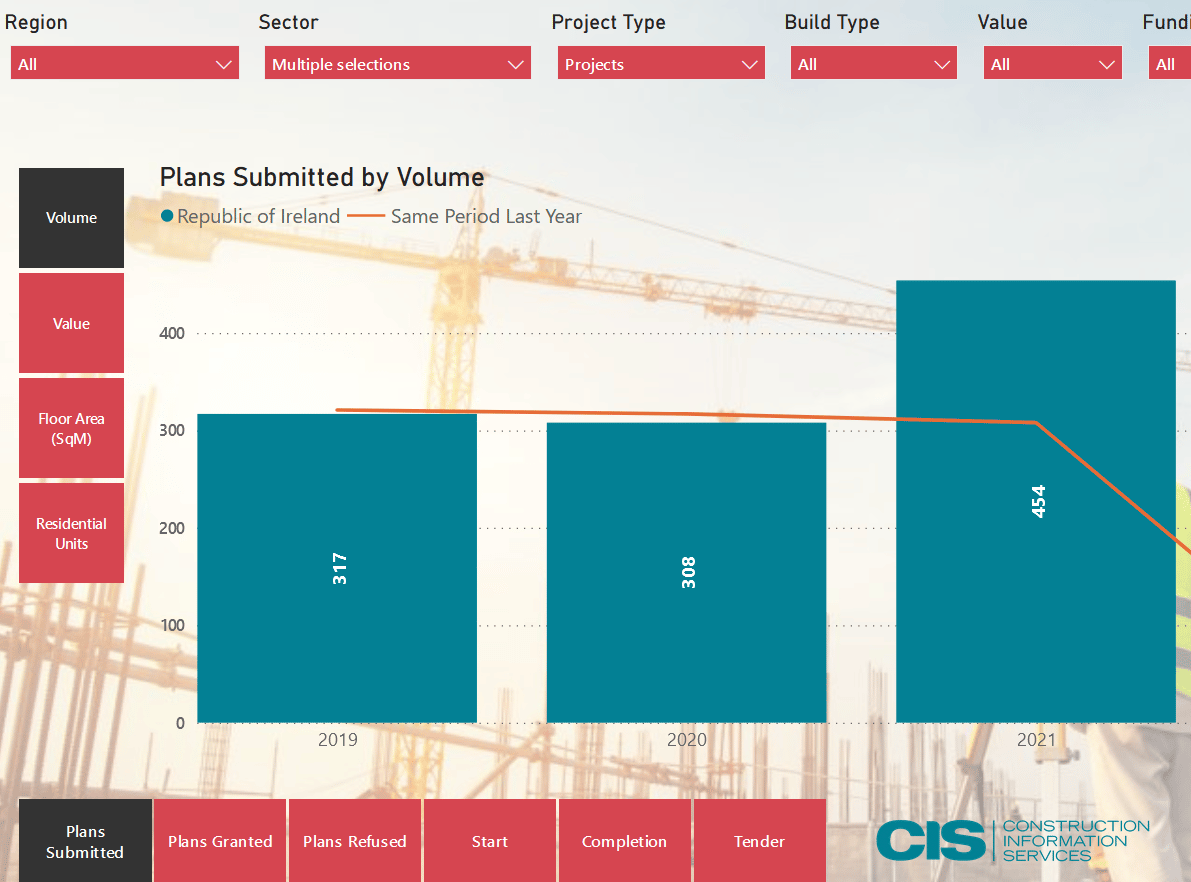

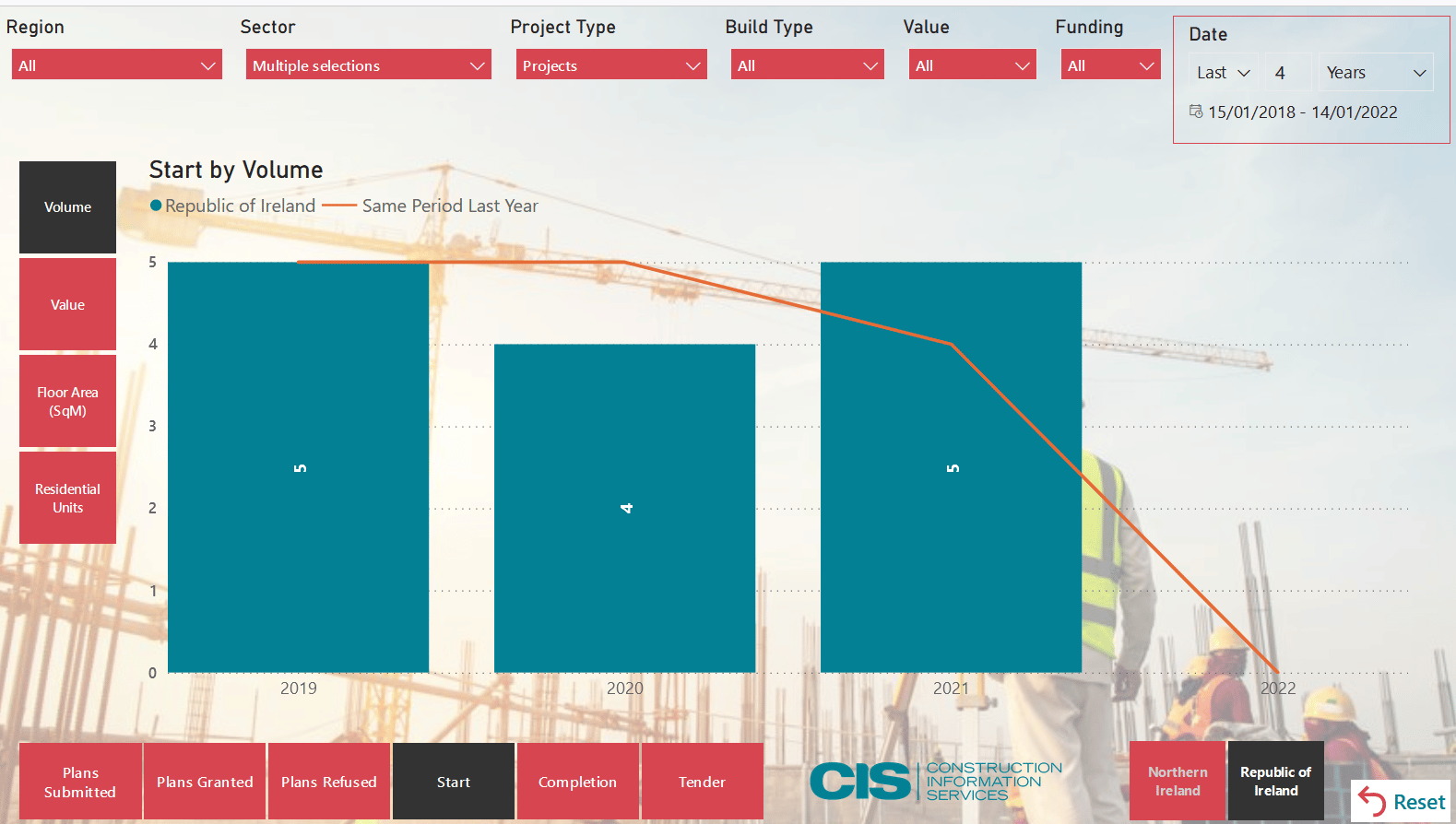

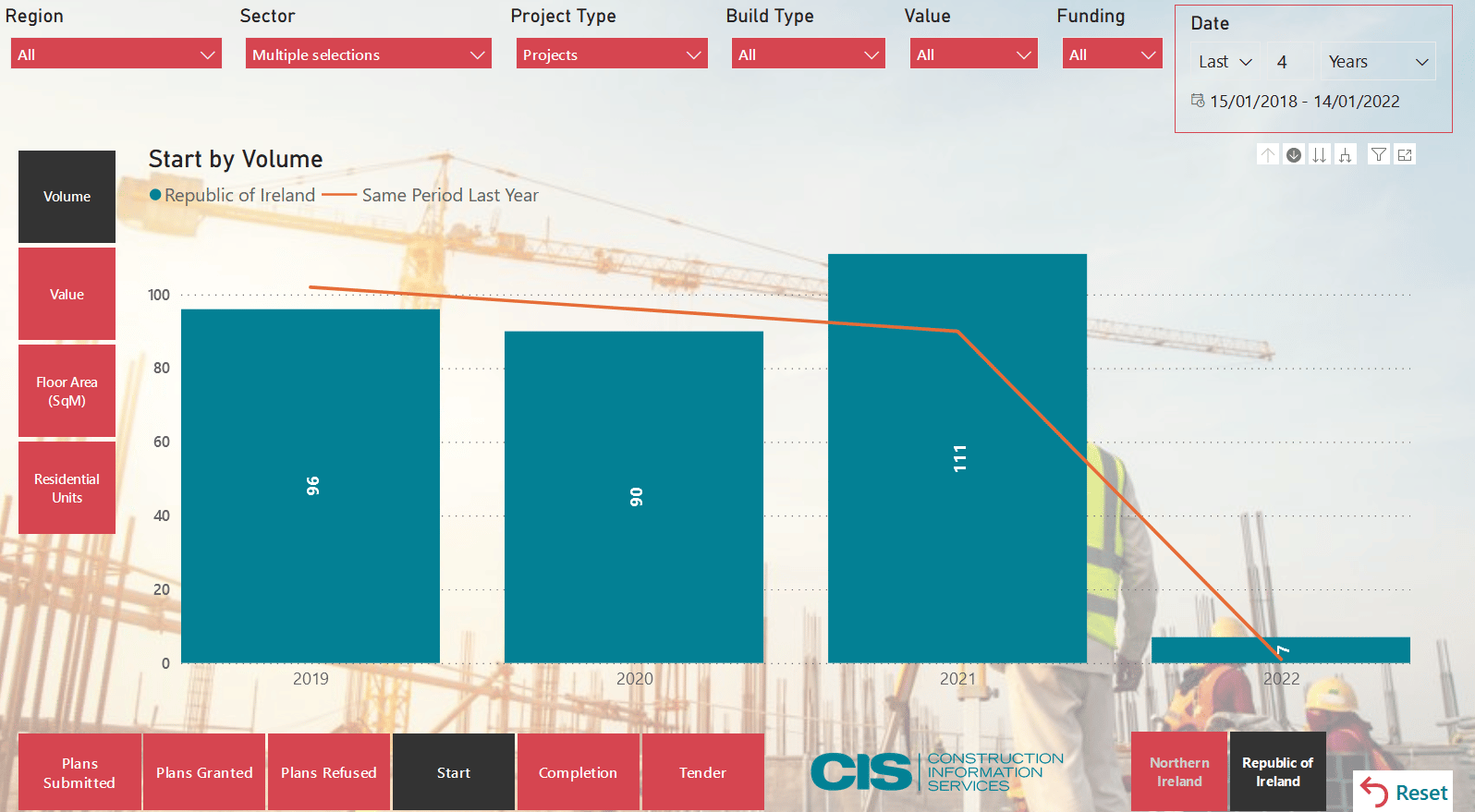

Construction following the height of the pandemic has been slow to recover and posed a significant concern to industries throughout the number of lockdowns and halting of work on site. According to the Central Statistics Office, both volume and value building construction output in 2020 were down year over year – by 5.2% and 4%, respectively – marking the first annual fall in final output since 2012. With this, the construction industry entered 2021, under immediate pressure and uncertainty faced with strict lockdown procedures brought in to combat Covid-19.

The first quarter of 2021 reflected the magnitude of setbacks in the construction industry as output fell 27.3% from a year earlier, following a downwardly corrected 6.0% drop in the previous three-month period. The residential sector was the hardest hit, with activity dropping 60.9%, followed by considerable drops of 19.5% in non-residential and 33.6% in civil engineering activity. Construction output fell by 21.0% on a quarterly basis, dropping from a 5.2% increase in the fourth quarter. (CSO)

In the third quarter of 2021, Ireland’s construction output fell 1.4% year on year, following an upwardly revised 28.4% increase in the preceding three months. Construction activity has also remained modest compared to pre-pandemic levels. Non-residential construction fell 6.5% compared to 23.7% in Q2, while residential construction rose 7.7% and civil engineering works rose 20.6%. Construction output increased by 7.5% on a quarterly basis, following a 9.9% increase the previous quarter.

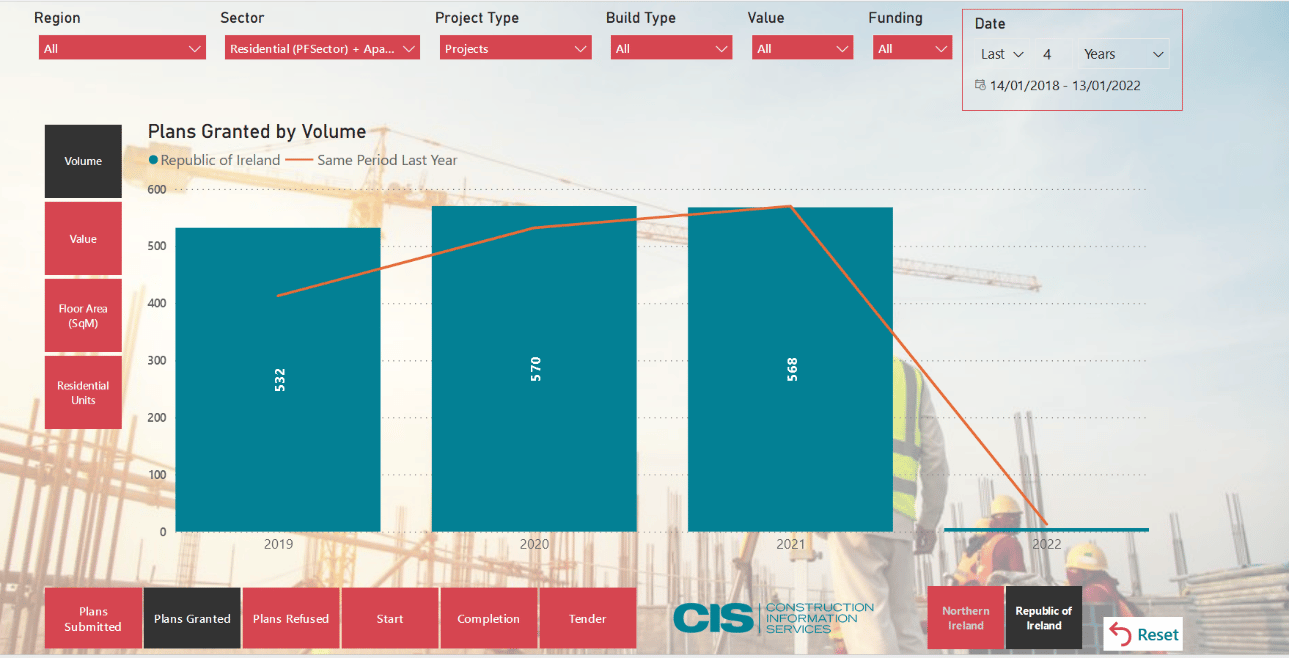

Residential

Residential construction has seen the most spotlight throughout 2021 and will continue to be for the foreseeable future. Movement on Build to Rent (BTR) projects has increased considerably now, compared when to when we were in the height of lockdowns over the past year. The current desire to increase residential construction and affordability has driven the current BTR model, a highly desirable and community-building endeavour. Currently, these projects consist of 30k+ apartment beds, which are spread across 1/2/3 bed apartments. It also includes 1,800+ student beds which in itself lends itself to the issue of education accommodation particularly in Dublin.

As of 15th March 2021, House rebuilding costs increased by an average of 7.3% nationally, over the last 18 months. Builders facing double-figure increases in raw materials, as suppliers warn customers of price increases ranging from 5-20%. This sentiment has maintained as prices have kept on increasing all of 2021. This higher cost of building materials could reasonably ‘lock out’ homebuyers from an already declining situation. These factors combined will no doubt see the residential sector in Ireland undergo varying levels of public and governmental scrutiny.

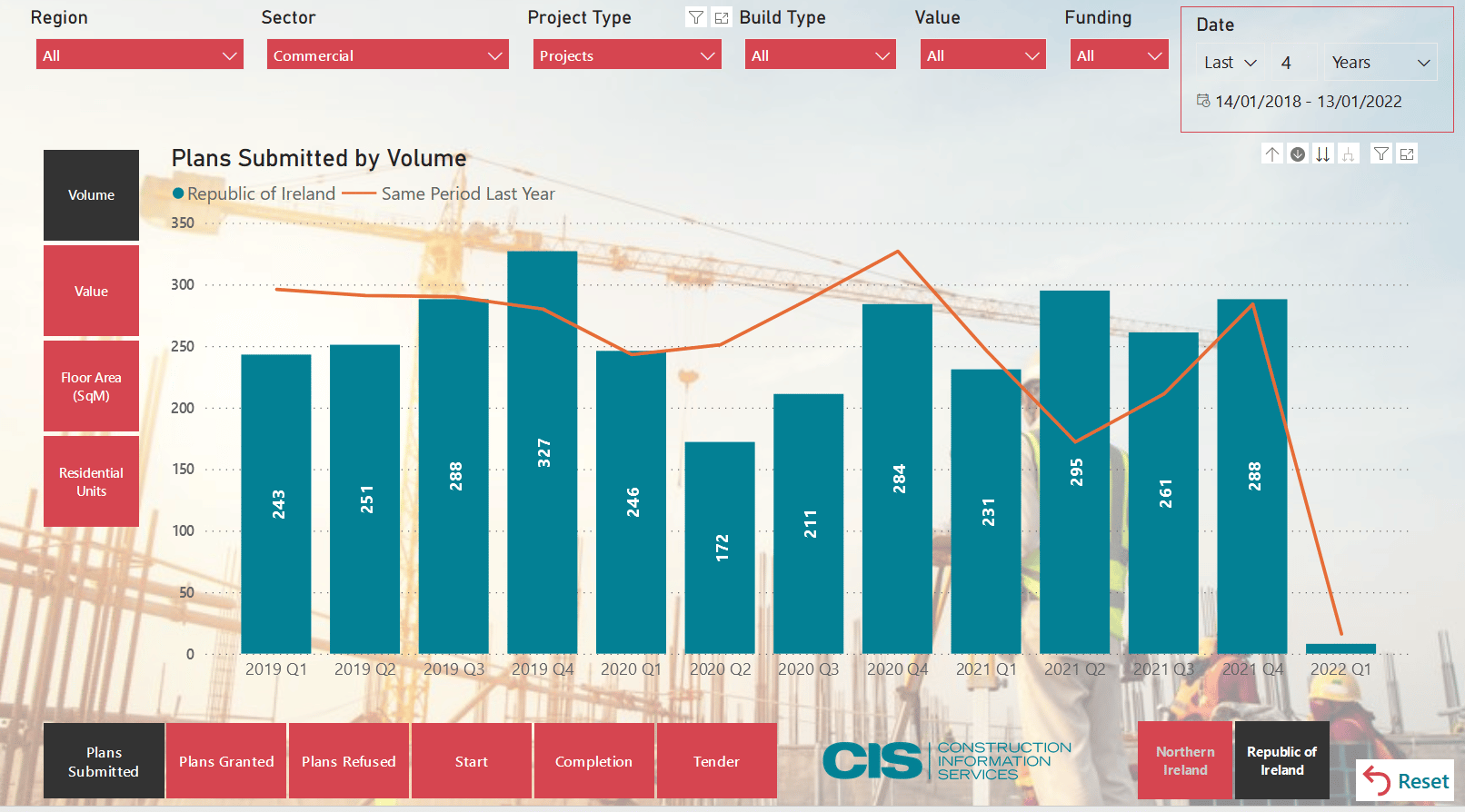

Commercial

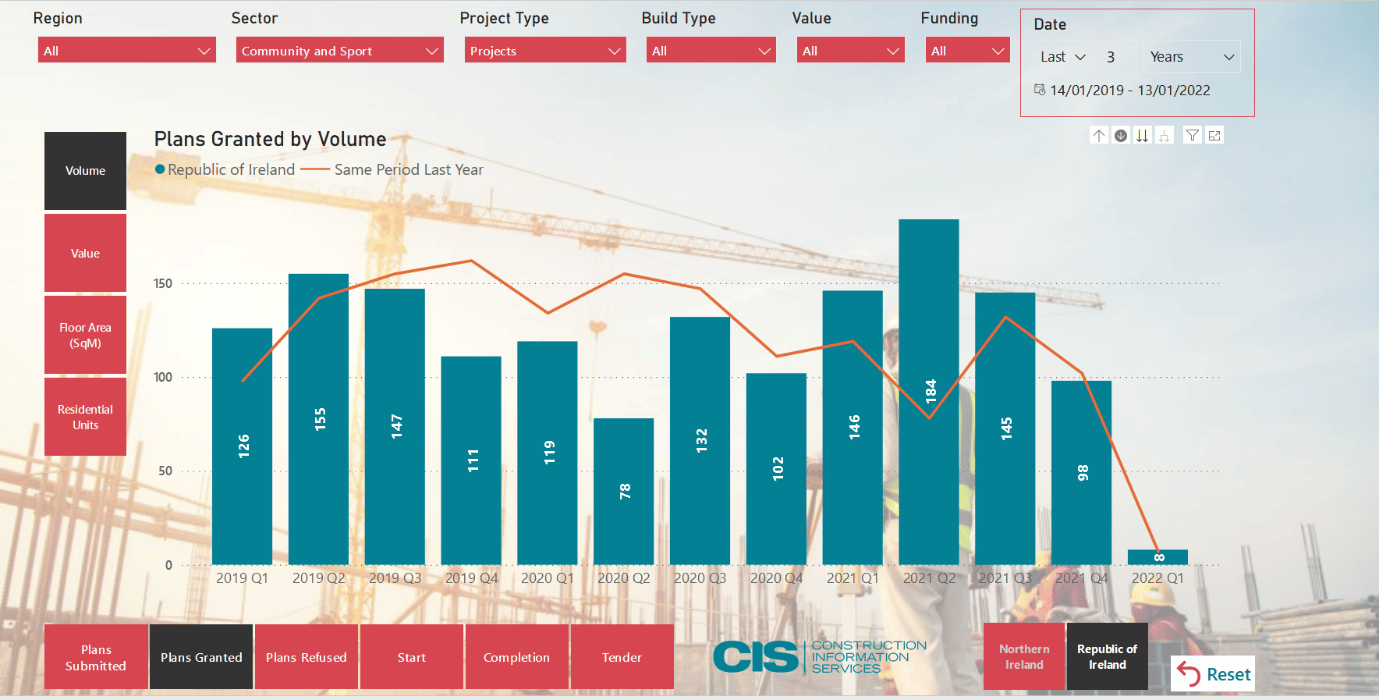

The commercial market in Ireland has seen a decrease in productivity in 2021, particularly in office & warehouse space construction, which has declined significantly since 2019. There are numerous possibilities for the cause of this decrease. Covid-19 has halted building across the board, but it isn’t the whole picture. With tax legislation coming into effect in Ireland, multinational corporations will have less of an incentive to remain primarily located in Ireland, therefore existing space will suffice. This is evidenced by the fact that, while GDP increased from 2020 to 2021, GNP did not increase in the same way, implying that multinational corporations have a lesser impact on the economy. Planning permissions submitted for these projects reduced from 214 in 2019 to 132 in 2021, a 38% decrease and the planning permissions granted reduced 147 in 2019 to 111 in 2021, a 24% decrease.

Education

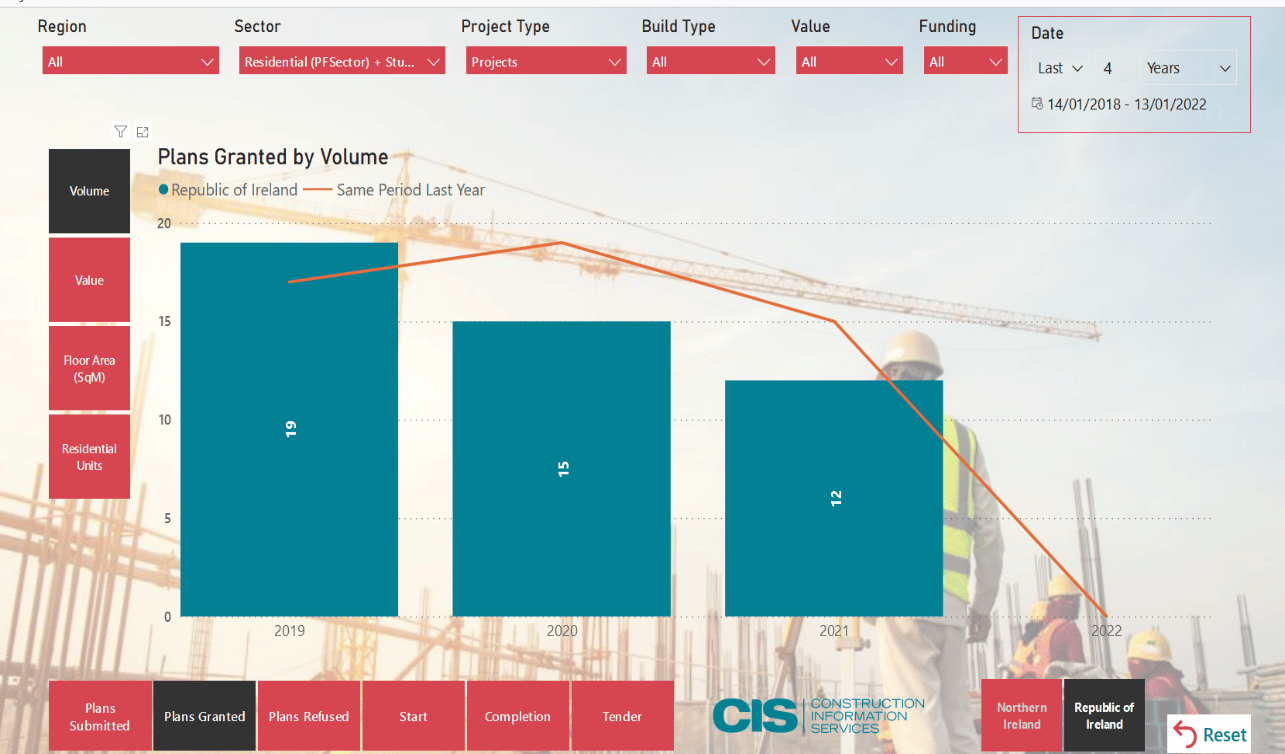

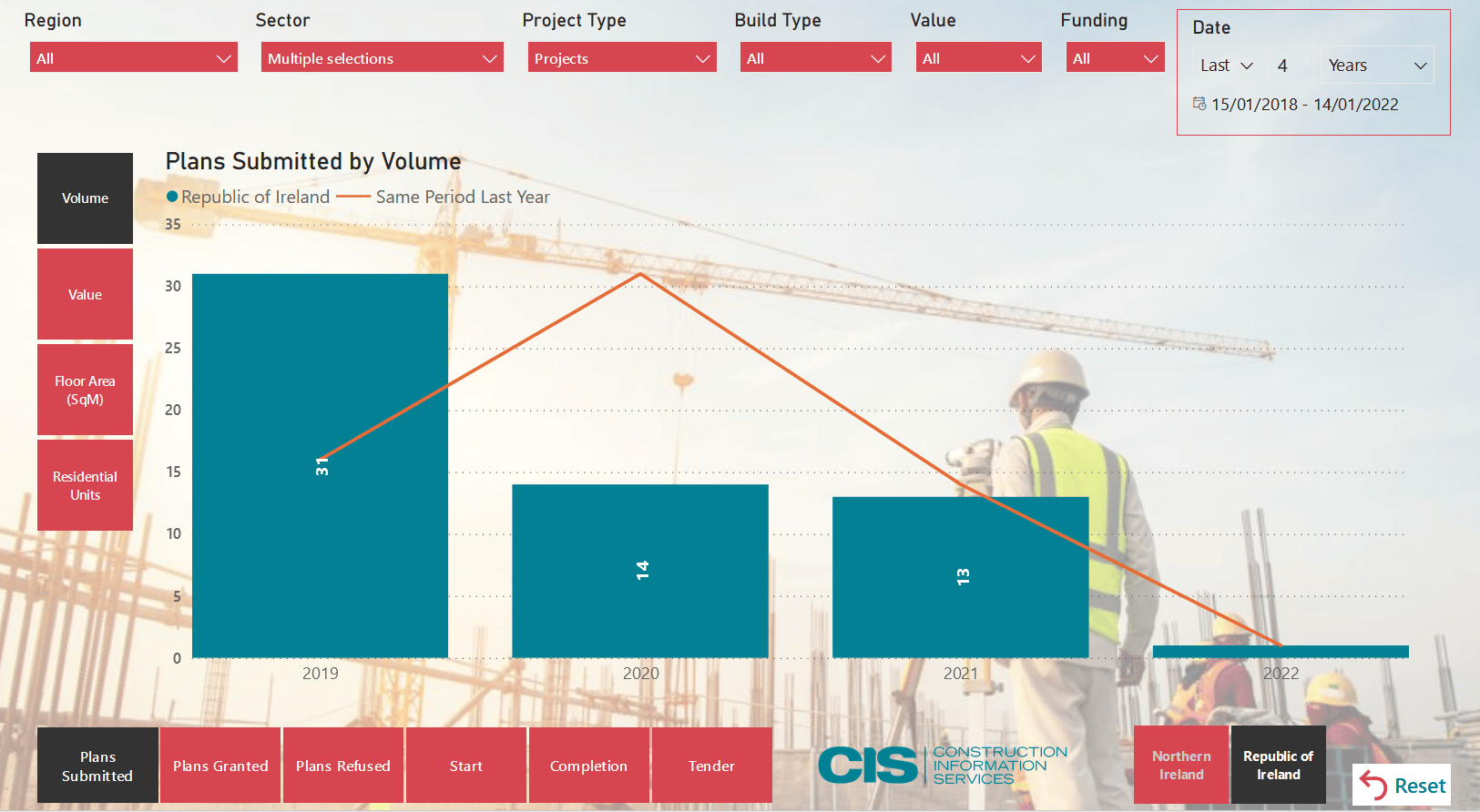

Covid 19 continues to place substantial pressure greatly impacting planning output and construction activity in the Educational Sector. In 2021, there was a general slowdown in the volumes of planning applications for primary, secondary school and third-level projects being submitted and approved across 3 provinces with the lowest activity was recorded in the West, Midlands and Border regions. In contrast volumes of applications, both submitted and granted in the greater Dublin Area and Eastern region were maintained.

On a positive note, in 2021 there was a substantial increase in the number of primary and secondary school projects completed, adding approximately 1,196 classrooms to our schools. Notable large-scale school projects brought to completion this year were the €30 million Carrigaline Education Campus in County Cork, the €20 million Clarin College Development in Newford, County Galway and the €19.2m new build for Swords Community College in County Dublin.

CIS has observed significant delays now being felt within the education sector. Through constant engagement with our information sources, who work to deliver these vital construction projects across the country, the spiralling costs of and access to materials required for the schemes is now having a serious effect on the previously agreed costs and the delivery dates of these projects. We have encountered several examples where originally appointed contractors are withdrawing from contracts and schools/education boards being forced to re-issue tenders and/or approaching originally unsuccessful tenderers.

A recovery for third level institutions seems promising, with a very notable increase in the areas of procurement and construction. There is approximately €739m worth of college projects at a tender stage which is a healthy 4.8% increase from what was recorded in 2020. Tenders are currently being sought for a €25 million extension to Galway Mayo Institute of Technology in County Galway which is part of the €200 million NDFA Higher Education PPP bundle. We have noted a slow-down in the planning pipeline for student accommodation projects with a 4.3% decrease in the number of schemes granted planning across the overall region. However, despite the downturn of output recorded, a total of 21 projects were completed this year. The majority of construction activity is concentrated in the Dublin and South-West regions. It might be possible to see a pick-up in these numbers as students return from prolonged remote learning as the pandemic restrictions are eased. There are some positive indicators here to signify a stabilisation in construction activity with many influential schemes continuing to move forward in 2022. It is hoped there will be more growth in 2022 with students returning to schools and campuses.

Industrial

There were positive indicators of growth and expansion in the Industrial sector in 2021. Construction of warehousing units, data centres, pharmaceutical campuses, and innovation hubs continue to play an important role in the Irish economy by providing skilled employment opportunities and construction jobs. Despite the inflation of construction supplies and distribution costs caused by Brexit measures, the industrial sector is thriving, with a steady increase in planning activity.

For the year ahead, Ireland’s ability to adapt and respond to globalisation is a determining factor for the growth and continued success of this sector. The Irish government continues to support Start-ups and SME’s by providing business grants and options in the area of upskilling. Advancements in the areas of engineering, electronics, software, robotics will help Irish manufacturers and businesses to not only continue their success domestically but also compete in the global market. It is noted that there has been considerable movement in planning tech hubs and collaborative co-working areas which should help remote working businesses.

The production of medical technologies and pharmaceuticals continues to demonstrate strong growth potential with major chains such as Pfizer and MSD planning expansions to their existing facilities in Ireland. Following Germany, Ireland is the second-highest exporter of medical devices in Europe with many of the leading medical device companies based here.

With data consumption and the demand for smart technology at an all-time high, the continued development of data centres is critical to the economic success of our country. In 2021, global tech giants such as Apple, Amazon, and EdgeConnex have all submitted new planning applications for data centres across Ireland, presenting a promising future, further positioning Ireland as a hub for global Data Centre excellence. Data centre players such as Amazon, Facebook, Intel, Cyrus One and Echelon continue to make their mark with growing campuses. Given the current scarcity of energy supplies and the strain on the national grid, the continued investment in renewable energy should be outlined in the preplanning and pre-construction stages of data centre development.

Construction within the industrial sector is expected to be challenged with cost-effectiveness, Covid 19, Brexit and bottleneck chain supply into the coming year. Government policy in the forms of funding and regulation can hopefully help mitigate the economic challenges in this sector in 2022. Cost competitiveness is an overruling factor affecting the success of construction within the industrial sector, with lack of finance being the main hindrance for companies and developers. The inflation of construction supplies, transportation of goods, energy, taxes and property all play a heavy hand in the expansion of warehousing, offices and research facilities.

Civil/Utilities/Transport

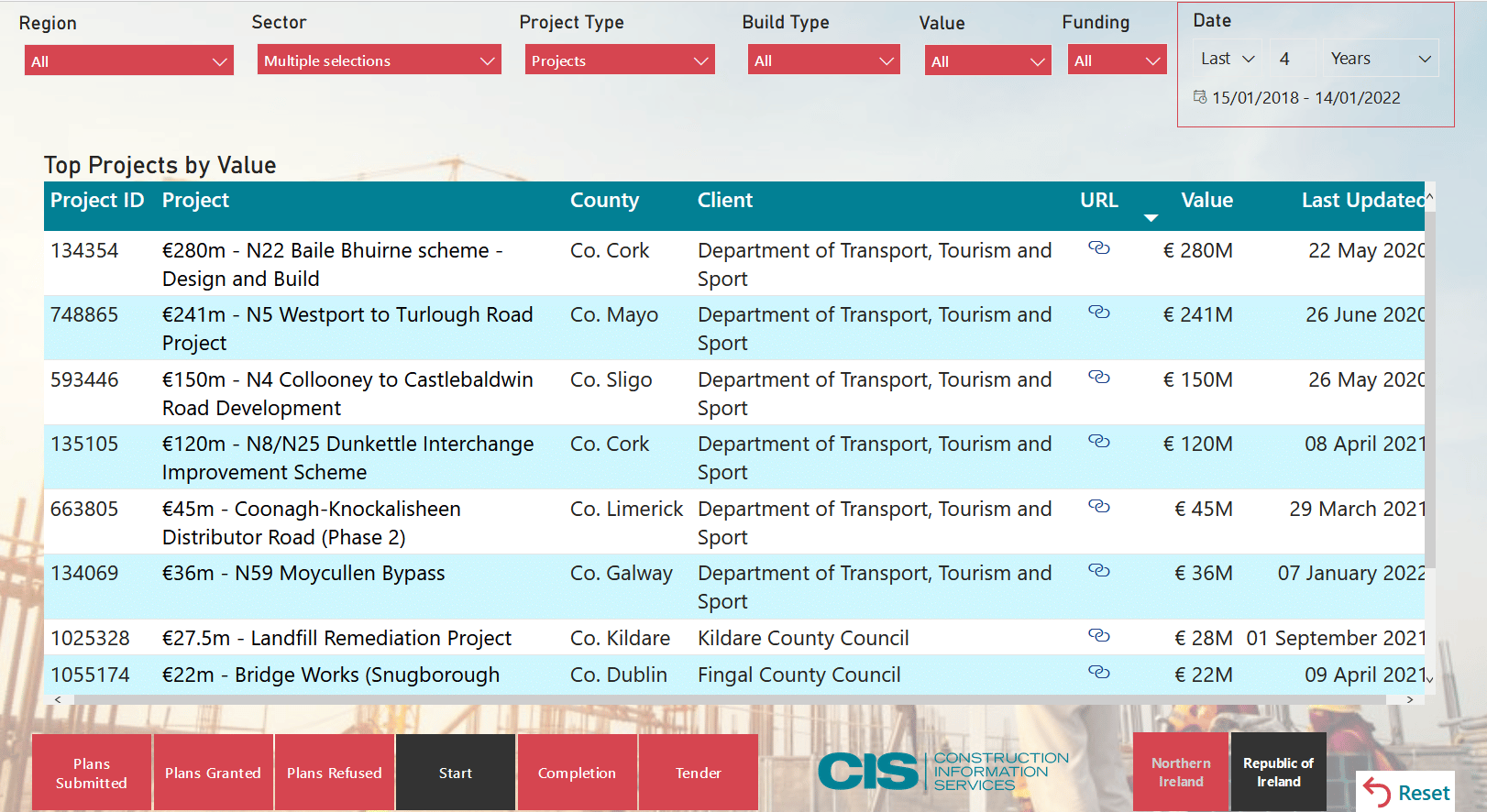

The Civil and Transport Sector continue to perform strongly with many infrastructural schemes continuing to move forward. The continued alignment of capital investment plans is essential for not only the development of physical infrastructure but also socio-economic growth benefiting businesses and communities across Ireland. This year brought around the review of key initiatives such as Project Ireland 2040 and the Greater Dublin Area Transport Strategy 2022-2042 programme which assess government efforts to date and future plans to accommodate Ireland’s growth.

However, despite remarkable progress on several schemes such as Busconnects, Luas Cross city and DART+, plans for the Metrolink is to face further delays and is now expected to be completed in 2034. The connection of a high-velocity transport system from Dublin Airport to the City Centre would be transformative for Dublin’s tourism and global accessibility. The ongoing enhancement of rail Services, road infrastructure, port expansions and airports are of vital importance ensuring efficient mobility and transportation.

The future of transport and regional connectivity in the West of Ireland is looking very strong with many key projects moving ahead. In December 2021, the €600m Galway Outer Bypass scheme got the green light following a long Oral Hearing process. Tenders are now expected to be sought in late 2023 with a target completion date of 2025. Despite delays with ongoing covid 19 protocols, there were considerable advancements including the completion of the N4 Collooney to Castlebaldwin in May 2021 by Roadbridge. The ongoing N8/N25 Dunkettle Interchange Improvement Scheme is also hoped to be brought to completion in 2023.

On a positive note, CIS recorded an increase of 67.3% of completed civil projects this year. The planning pipeline of the civil sector remains strong with a 15.1% increase of submitted projects and a 48.6% increase of projects granted planning. For the coming year, continuing the rollout of greenway schemes, public realm and parks, as well as minor road works is vital to addressing the key infrastructural needs in both rural and urban communities.

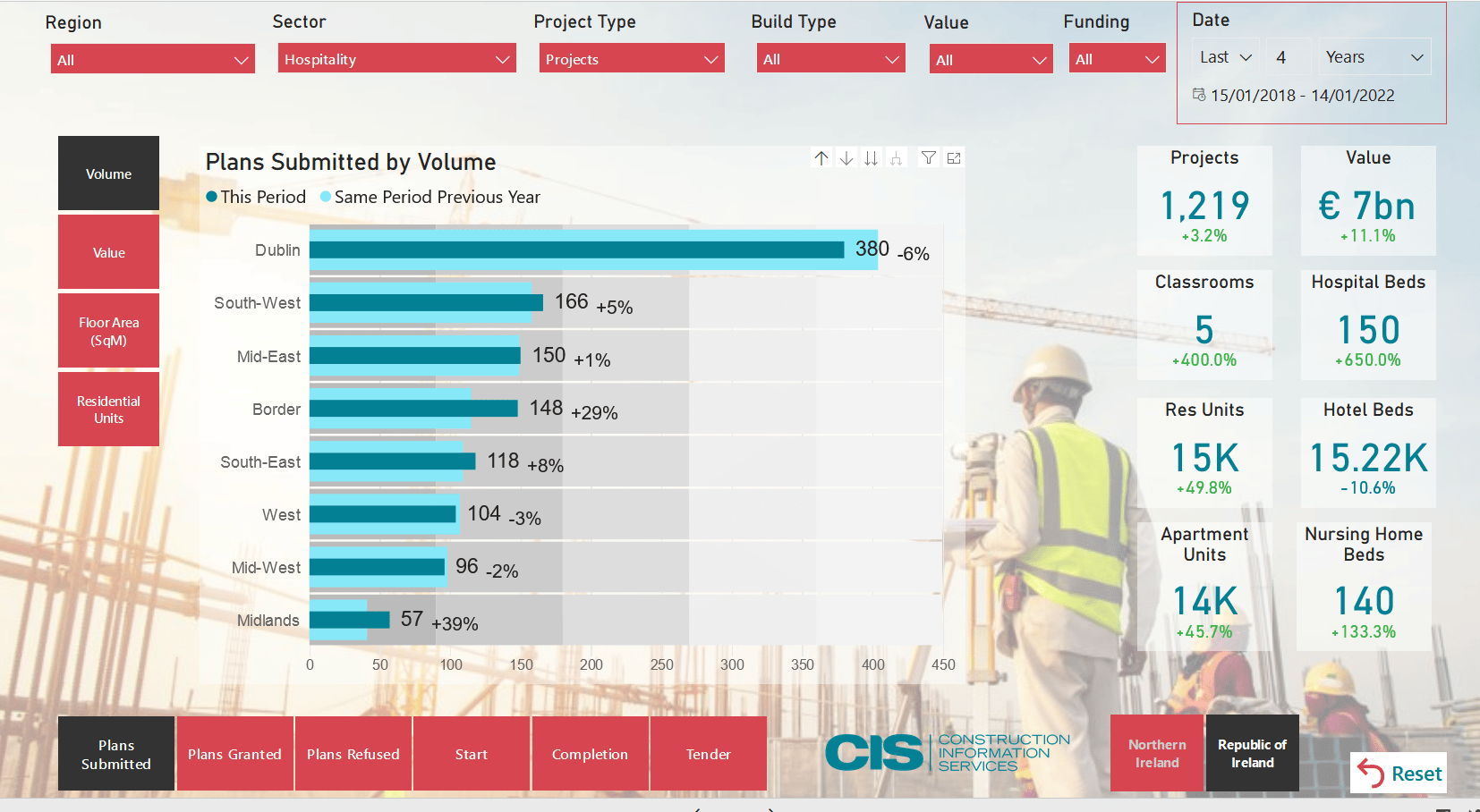

Hospitality & Leisure

With Tourism down, the demand for hotel development is practically non-existent. This has resulted in CIS witnessing a decrease in planning applications being lodged for brand new city hotels or extension/refurbishment works and their cumulative value, over the past year.

Work is currently underway on a €150 million hotel development at 18 – 27 O’Connell Street Lower in Dublin 1. This will provide 200+ bedrooms and should be completed by early 2022.

In Southwest Gate, Dublin, plans have just been granted for the mixed-use development comprising apartments, offices, cinema, café, health centre, gymnasium, creche and hotel consisting of close to 150 beds. The Opera Centre Development which includes a restaurant is now at the tender stage.

Sports & Community

There has been an increase in the volume of plans submitted (YOY) from 2019-2021, leaping from a total of 226 applications in 2020 to 358 in 2021. Although the value has decreased when calculating the total approximate costs from €2.03 billion to €1.84 billion but still a fair increase for the total of 2019 (€1.14 billion). The total approximate value of projects started in 2021 is €450 million, an upward trend from €290 million in 2020. Works on the €58 million apartment development (build to rent) including a gymnasium at Davitt Road in Dublin is expected to finish in Q1 of 2022.

As of the 4th of October, The Minister for Tourism, Culture, Arts, Gaeltacht, Sport and Media, Catherine Martin TD, and Minister Jack Chambers TD, Minister of State with responsibility for Sport and the Gaeltacht, today welcomed the launch of the National Development Plan 2021-2030, following an extensive review.

The revised NDP sees a total public investment of €165 billion over the period 2021-2030. This will bring public investment to 5% of GNI*, well above the recent EU average of 3% of GDP. This will include a significant package of capital investment of over €1bn from the Department of Tourism, Culture, Arts, Gaeltacht, Sport and Media over the period 2021 to 2025.

Conclusion

According to Trading Economics global macro models and analysts, construction output in Ireland is predicted to increase by 9.5% by the end of 2021 and will trend around 5.2% in 2022 and 3.2% in 2023 in the long run. (Trading Economics). It’s worth mentioning that these promising rates of growth are dependent on the assumption that we do not experience a further decline due to potential lockdown measures.

Sign up for a Free Trial and System Demonstration HERE!

Content researched and written by Josh Wiler, Adam Dargen, Sharon O’Rourke from Construction Information Services. For more information, please contact [email protected] or call us on +353 1 2999 200.

Download CIS reports by clicking the button below.

Download CIS reports by clicking the button below.